US President Donald Trump has announced a sweeping 50 percent tariff on all imported copper, effective August 1, citing national security concerns. The sweeping trade measure sent copper prices soaring and rattled global markets, raising fresh questions about the resilience of supply chains for the key industrial metal.

The announcement followed Trump's initial hint on Tuesday about potential copper tariffs, which triggered an immediate market reaction. Copper futures on the New York-based COMEX exchange surged 13 percent that day, with volatility continuing into Thursday's Asian trading hours as prices climbed to $5.61 per pound, indicating ongoing investor unease about the policy's effects.

Trump's tariff exposes US supply shortfall and risks driving up costs

The tariff reflects Trump's longstanding concern over America's heavy reliance on imported copper. However, analysts caution that while the policy aims to boost domestic production and protect strategic industries, it is unlikely to significantly increase US copper output in the near term – and may instead exacerbate price pressures.

"The US remains structurally short on copper," said Ole Hansen, head of commodity strategy at Saxo Bank. "Addressing that shortfall will take years, if not decades."

Supporting this, data from the US Geological Survey shows that in 2024, US copper mine production was approximately 1.1 million metric tonnes, down 3 percent from the previous year and representing only 4.8 percent of global output. Meanwhile, multiple sources including the Wall Street Journal and Politico estimate that 45 percent to 50 percent of US copper demand is met through imports, underscoring the structural supply gap.

As a result, Hansen warns that tariff-induced price premiums will likely make copper – and by extension US manufacturing, infrastructure projects, and clean energy development – materially more expensive.

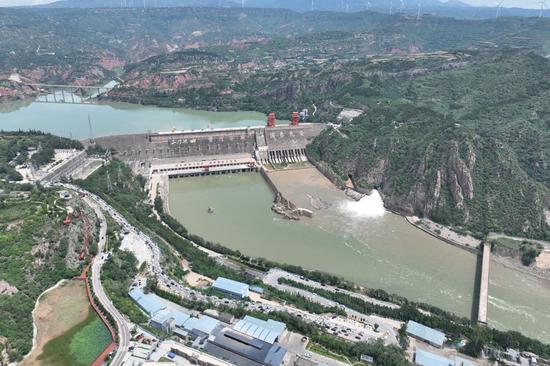

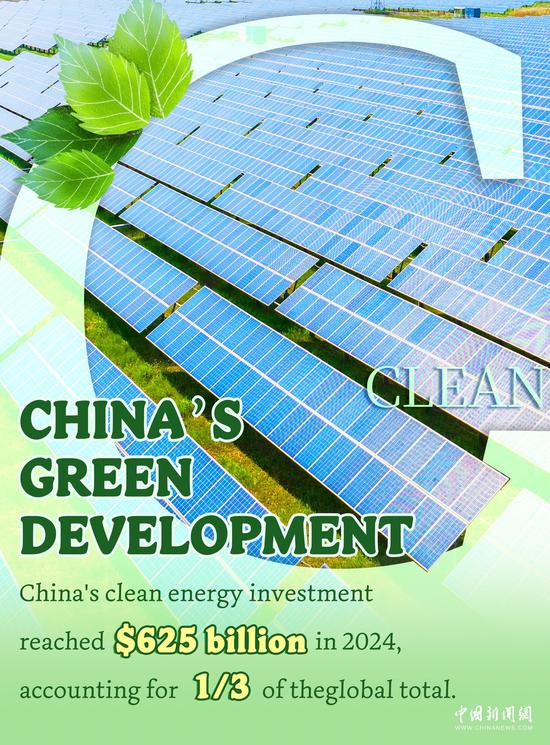

Copper is a vital input in sectors ranging from construction and power grids to electric vehicles, semiconductors, and renewable energy infrastructure. Industry groups have expressed concern that rising raw material costs could strain project budgets and reduce the competitiveness of US-based manufacturers, especially in energy-intensive industries already grappling with inflation.

Citigroup calls tariff a "Watershed Moment" as import window closes

Citigroup described the tariff as a "watershed moment" that effectively closes the door on large-scale copper shipments into the US, reshaping global trade flows, according to Bloomberg.

Macquarie analysts estimate US copper imports reached 881,000 metric tonnes in the first half of 2025, almost double the estimated domestic requirement of 441,000 tonnes, reported Reuters. This discrepancy reflects a wave of preemptive stockpiling by importers ahead of the tariff's implementation.

Once the tariff takes effect, Macquarie expects this inventory buildup to unwind, with buyers shifting from stockpiling to drawing down reserves. This change could disrupt existing pricing trends and potentially establish a new supply-demand equilibrium.

The tariff's overall impact will depend heavily on specific details, including the exact rate, which forms of copper are subject to the levy, and whether any grace periods are granted before enforcement, Bloomberg quoted Marcus Garvey, Macquarie's head of commodities strategy, as saying.

京公網安備 11010202009201號

京公網安備 11010202009201號