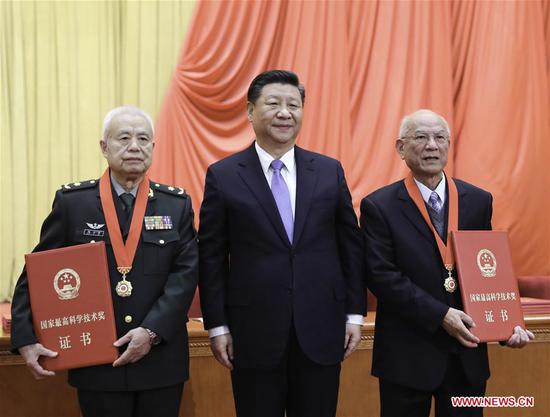

To provide accurate liquidity support for China's small and micro enterprises, the People's Bank of China will leverage a basket of policy tools this year, Yi Gang, the central bank's governor, said in an interview.

The basket, Yi said, includes targeted reserve requirement ratio cuts, relending and rediscounting and the targeted medium-term lending facility, Xinhua News Agency reported late on Wednesday. "The first TMLF operation will be implemented in late January," he said.

Yi also pledged to "help ease the finance strain of some private enterprises through a full use of credit, bonds and equity financing".

While using targeted measures to boost the vitality of small, private businesses, Yi reiterated that overall liquidity will be maintained at "a reasonable level" to avoid fast credit shrinkage while refraining from indiscriminate easy credit.

Speaking of this year's strategy of preventing and resolving major financial risks, Yi prioritized "stabilizing the macro leverage ratio" and "properly dealing with shocks from major external uncertainty on financial markets".

"We will adhere to the road map of structural deleveraging, and properly resolve the risk of local government debts," Yi said.

Capital market reforms will be deepened to shore up market confidence, he added. "We will strive to maintain the steady and healthy development of the stock, bond and foreign exchange markets."

Yi also called for better policy coordination to resolve different types of financial risks, including existing risks and potential, unexpected problems.

"We will continue to crack down on illegal financial institutions and activities, if any, as early as possible," Yi said, adding that the regulations on handling illegal fundraising activities are in the pipeline.

Yi's remarks followed the tone-setting annual Central Economic Work Conference in December. The conference set a prudent monetary policy stance for 2019, and called for smoother monetary policy transmission to better transfer money supply growth to credit growth.

"To improve the transmission mechanism, the key is to establish an incentive mechanism for banks to support the real economy, instead of administrative measures such as setting targets and assigning tasks to banks," Yi said.

On Friday, the PBOC announced a cut in the reserve requirement ratio for all financial institutions by 1 percentage point in two phases in January, aiming to increase loan funding sources for small, micro and private businesses.