Experts clarify it's not dumping but recast of China's overseas assets

China's continued paring of its U.S. Treasury holdings is necessary given both the deteriorating quality of U.S. debt held by foreign governments and institutions, and China's need to optimize the structure of its overseas assets, experts said.

According to Treasury International Capital or TIC data released by the U.S. Department of the Treasury on Tuesday, China held a net $769.60 billion of U.S. government bonds in October, down $8.5 billion from a month earlier and the lowest since 2009. It was also the seventh consecutive month of such decline.

The TIC reporting system represents the U.S. government's source of data on capital flows into and out of the U.S.. Direct investment and the resulting levels of cross-border claims and liabilities are excluded from such data. China is the second-largest foreign holder of U.S. government bonds, next only to Japan. China's holdings of U.S. Treasurys have contracted by nearly $100 billion so far this year.

Yu Yongding, a member of the Academic Divisions of the Chinese Academy of Social Sciences, said at a forum on Sunday that China's reduced holdings should not be misunderstood as the country is dumping U.S. debt. It is just that China has not bought new bonds when previously invested bonds matured.

Yu, who served as an advisor to the People's Bank of China, the country's central bank, in the past, stressed it is "necessary" for China to reduce its U.S. Treasury holdings in an orderly manner, given the deteriorating quality of U.S. debt held by others, the lower coupon rates on U.S. Treasurys and the likelihood of an economic downturn in the U.S..

In 2006, the ratio of net debt to GDP in the U.S. had exceeded 10 percent, unsettling the capital market. That ratio has surged to 60-70 percent now. This indicates that net U.S. debt held by foreign entities will continue to worsen, which may be aggravated by the Fed's continued interest rate spikes. Therefore, China's orderly trimming of U.S. Treasurys is quite necessary, he said.

In August, Fitch Ratings lowered its U.S. credit rating to AA+from AAA. Moody's Investors Service lowered its outlook on U.S. government debt in October to "negative" from "stable" due to large fiscal deficits and a decline in debt affordability.

Yu said China should step up its efforts to adjust the structure of its overseas assets and liabilities, increase its income from overseas net assets, and try its best to reduce its foreign exchange reserve to an adequate level that is internationally recognized.

To maintain the safety of China's foreign reserves and overseas assets, the country should try to maintain a balanced foreign trade and make the domestic market its economic mainstay over a period of time, Yu said.

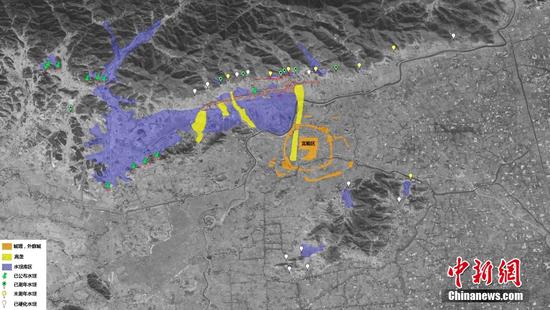

Wang Qing, chief macroeconomy analyst at Golden Credit Rating, said China's reduced holdings of U.S. bonds have been a long-term trend since its peak toward the end of 2013. Over a decade, the holdings have declined nearly 34 percent. During the same period, China's gold reserves have continued to rise, reaching 70.46 million ounces at the end of September, more than doubling from the level at the end of 2013.

This can be seen as part of China's long-term moves to optimize the structure of its foreign exchange reserves assets, he said.

TIC data showed overall foreign holdings of U.S. Treasurys fell for the second consecutive month to around $7.57 trillion in October, down from more than $7.60 trillion in September.

Luo Zhiheng, chief economist of Yuekai Securities, said demand for U.S. Treasurys has been insufficient mainly because of the Fed's shrinking of balance sheet and emerging markets selling U.S. Treasurys since July to stabilize their exchange rates against the rising U.S. dollar.

Following the Silicon Valley Bank collapse in March, U.S. commercial banks' ability to absorb U.S. Treasurys has declined. U.S. domestic institutions have become especially cautious about buying long-term bonds, Luo said.

京公網安備 11010202009201號

京公網安備 11010202009201號