Nation No 2 holder of U.S. Treasuries after Japan as China diversifies assets

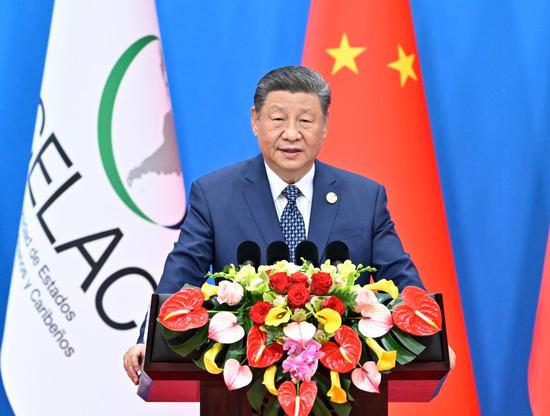

High-rises dominate the skyline on both sides of the Huangpu River in Shanghai. (Photo by Gao Erqiang/China Daily)

While China is poised to gradually diversify its foreign exchange reserves away from U.S. dollar assets in line with shifts in trade structure, the country remains committed to safeguarding global financial resilience — with the stability of the U.S. Treasury market serving as a key pillar, economists and financial experts said.

They made the remarks as China's approach to its massive holdings of U.S. debt — a delicate topic with implications for global markets — could surface at the negotiating table as the world's two largest economies agreed to continue talks on economic and trade relations.

"One of the key expectations from the U.S. side may be for China to maintain a stable level of U.S. Treasury holdings and to refrain from large-scale sell-offs over a short term," said Yang Weiyong, an associate professor at the University of International Business and Economics.

While China could, in theory, use its holdings as a strategic deterrent, decisions on whether to increase or reduce its holdings are primarily driven by market-based considerations — such as U.S. Treasury yields and expectations for future price movements, Yang said.

"China is a major holder of U.S. debt, so we too want the market to remain stable. That stability benefits the global economy, especially considering that $8.8 trillion in U.S. Treasury securities are held by foreign governments and institutions."

As the second-largest U.S. creditor nation after Japan, China held $784.3 billion in U.S. Treasury securities as of the end of February, up from $760.8 billion from a month earlier, data from the U.S. Department of the Treasury showed.

Since April, concerns have mounted in Washington over whether major foreign holders of U.S. debt — such as China and Japan — might reduce their holdings amid heightened trade tensions.

Even as tensions have eased as China and the U.S. announced on Monday that they will drastically roll back tariffs on each other, the issue remains unresolved. With the U.S. government edging closer to a potential bond default, continued support from major creditors is seen as vital to rolling over its debt.

Last week, U.S. Treasury Secretary Scott Bessent urged Congress to raise or suspend the federal debt ceiling by mid-July, warning that failure to act could leave the U.S. government unable to meet its obligations as early as August.

Yang said he does not believe China has any intention of using the sale of U.S. debt as a retaliatory measure against Washington — at least for now — as the country aims to contain bilateral economic disputes within the trading sphere to avoid broader frictions.

Still, holdings of U.S. Treasury securities would be one of the bargaining chips in China's favor, said Hong Hao, a renowned economist.

Hong added that China is in the process of diversifying reserve holdings in the long run, with gold as an apparent choice.

"Other than gold, China is developing trade relationships with other countries and thus the reserve holdings must reflect the newly formed trade relationships," he added.

Zou Lan, deputy governor of the People's Bank of China, the country's central bank, said in late April that China has achieved "effective diversification" of its foreign exchange reserve portfolio, guided by market-oriented and professional investment principles.

China's foreign exchange reserves totaled $3.2817 trillion at the end of April, up by $41 billion, or 1.27 percent, from March, while the country's official gold reserves came in at 73.77 million ounces, up from 73.7 million ounces a month earlier, marking the sixth consecutive month of increases, the State Administration of Foreign Exchange said.

京公網安備 11010202009201號

京公網安備 11010202009201號