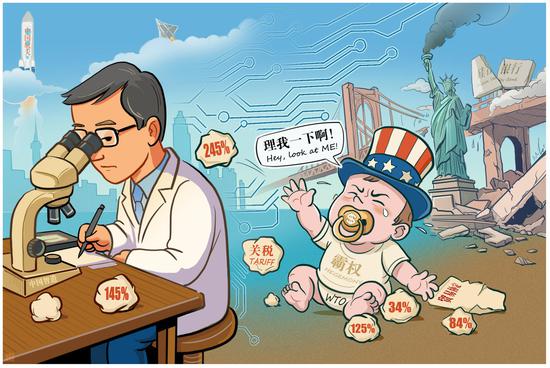

China will kick off on April 24 the issuance of this year's ultra-long-term special treasury bonds — a major off-budget tool to boost growth and address structural challenges — worth 1.3 trillion yuan ($178.3 billion), as policymakers front-load fiscal stimulus moves to proactively counter the incoming demand shock stemming from U.S. tariffs.

To be issued at a larger size and faster pace than last year, the bonds will effectively create demand for investment and consumption while reiterating policymakers' commitment to growth stabilization, analysts said, with additional government bond issuances possible in the second half.

The Ministry of Finance said a total of 21 tranches of such bonds — totaling 1.3 trillion yuan, up 300 billion yuan from last year, and with maturities of 20, 30 and 50 years — will be issued from Thursday to Oct 10.

On Thursday, bidding is set to be done for the first two issuance tranches worth 121 billion yuan in total — one tranche worth 50 billion yuan with a 20-year maturity, and the other worth 71 billion yuan with a 30-year maturity. Interest on the bonds will begin accruing from Friday and will be paid semiannually, the ministry said.

Li Yishuang, chief fixed-income analyst at Cinda Securities, said the bond issuances began earlier than expected — a month ahead of last year's schedule — possibly reflecting the front-loading of fiscal stimulus in response to potential impacts from the U.S.' tariff measures.

Liu Gangling, vice-president of Bank of Tianjin, said that Thursday's issuances represent a proactive fiscal policy measure by the central government, contributing to both short-term economic growth and laying the foundation for high-quality development over the long term.

"In the face of a complex external environment, the issuances will not only help expand effective demand, but also promote supply-side upgrades," Liu said.

In addition to more efficient issuance arrangements, this year's issuance plan also features improved fund allocation, reflecting policy priorities of expanding domestic demand and boosting consumption, said Sun Lin, managing director of fixed income, currencies and commodities department at China International Capital Corp Ltd. Of the total, 800 billion yuan will be allocated to projects in line with major national strategies and aimed at enhancing security capacity in critical areas. The remaining 500 billion yuan will support large-scale equipment renewals and consumer goods trade-in programs, with 300 billion yuan specifically earmarked for trade-ins — a 150 billion yuan increase from last year.

According to estimates from ratings agency CCXI, the 1.3 trillion yuan in ultra-long special treasury bonds could lift China's GDP growth by 1.7 to 1.9 percentage points this year, while stronger monetary easing will be needed to complement the fiscal push.

Lu Ting, chief China economist at Nomura, said the country has the scope for approving additional government spending quota in the second half, with spending focuses likely on boosting services consumption, improving the social security system, safeguarding real estate project delivery and providing liquidity support for developers.

京公網安備 11010202009201號

京公網安備 11010202009201號