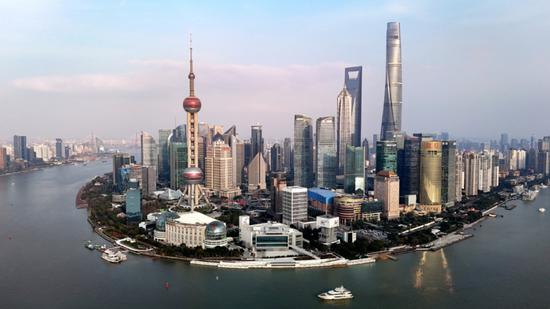

A view of the Lujiazui financial hub in Shanghai. (ZHANG JINGANG/FOR CHINA DAILY)

Apart from providing an exit channel for PE firms, S funds can serve as a "relay mechanism "between the primary market and the stock market by coming up with various products and professional practices, said Yang Bin, president of the Shanghai Science and Technology Innovation Fund, the manager of the newly launched 10 billion yuan S fund in Shanghai.

In this sense, S funds can help better connect technology companies with providers of financial services and industrial capital, he said.

The municipal government of Shanghai is well aware of the importance of S funds, which are indispensable in building a multilevel capital market. In September 2022, an S fund alliance was formed in Shanghai, comprising more than 80 leading securities firms, banks and funds of funds from home and abroad.

At the beginning of this year, Shanghai introduced a set of 32 measures to facilitate the high-quality development of equity investment. Among them, the development of S funds in the city was stressed.

Banks' asset management subsidiaries, insurers, trusts and State-owned funds of funds are encouraged to step up their investment in S funds and ensure their expansion. This is part of the city's efforts to better serve the real economy and stimulate technology innovation by giving more play to equity investment, according to the government document.

Data from Beijing-based PE services platform FOF Weekly showed that the total trading value of China's S funds was around 60 billion yuan in 2023. Globally, the trading size surged rapidly to over 112 billion yuan last year from only 22 billion yuan in 2010.

Wang Ke, senior director of Shanghai-based Gopher Asset Management, said that there is much room for growth of China's S fund market, given its low penetration rate and PE firms' high demand for profitable exits from their investments.

The focus on S fund development is just one example of Shanghai's recent efforts to improve its financial ecosystem for technologically advanced enterprises.

A new board for small and medium-sized companies specializing in niche sectors, commanding high market share and boasting strong innovation capacity, started trading at the Shanghai Equity Exchange or SEE — it is different from the Shanghai Stock Exchange — on March 26, with the first batch of 162 companies successfully listed.

The new board is directly connected to the China Securities Regulatory Commission, the country's top securities watchdog, by using blockchain technology, said Guan Xiaojun, president of Shanghai Exchange Group, the parent company of the SEE.

Such a connection can help more companies specializing in frontier technologies but still in their early stage of development, and those with much growth potential, as they will be brought under the regulatory radar. In other words, the candidate pool for listed companies will be expanded, which is conducive to improving the quality of listed companies, he said.

京公網安備 11010202009201號

京公網安備 11010202009201號