China's fiscal authorities will intensify efforts in areas like fully supporting sci-tech innovation and expanding domestic demand to further facilitate economic recovery, a senior official from the Ministry of Finance said on Monday at a news conference in Beijing.

"Fiscal revenue and expenditure registered in the first quarter showed that fiscal policy has come into play early with accelerated delivery of effects, providing strong support for the continuous improvement of the economy," said Wang Dongwei, vice-minister of finance, adding that for the next step, the ministry will focus on six key fronts to consolidate upward momentum of the economic recovery.

For one thing, the ministry will fully support industrial advances through scientific and technological innovation, he said.

"Aligning with national strategic needs, we will increase investment in basic research, applied basic research and cutting-edge research, and promote the accelerated implementation of a number of major national sci-tech projects to support the research of disruptive and cutting-edge technologies and seek breakthroughs in key core technologies," Wang said.

The ministry will also implement structural tax and fee reduction policies focused on supporting sci-tech innovation and the development of manufacturing.

Additionally, it will coordinate the application of policy tools — such as special fiscal funds and government investment funds — to support the growth of strategic emerging industries and the accelerated transformation and upgrade of traditional sectors.

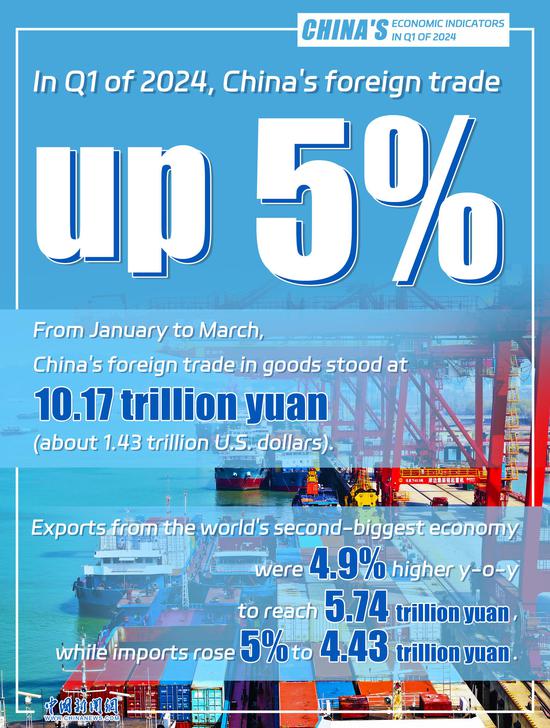

Data from the ministry showed on Monday that the country's fiscal expenditure expanded 2.9 percent year-on-year in the first quarter.

In the first quarter, national general public budget revenue totaled about 6.09 trillion yuan ($840 billion). After adjusting for special factors — including reductions and delayed collections of some taxes — the comparable growth was approximately 2.2 percent, continuing the positive growth trend.

Among the fiscal revenue, tax revenue totaled around 4.92 trillion yuan. If excluding special factors, tax revenue for the period actually grew stably.

To expand domestic demand, Wang said the ministry will make coordinated use of policy tools including treasury bonds, local government special bonds and central government budgeted investments, to effectively promote effective investment. It will also further improve supportive fiscal policies to promote consumption in areas like vehicles and home appliances, he added.

In addition, it will promote coordinated development between regions and strengthen the implementation of the fiscal budget and supervision of fiscal performance, to get the most out of fiscal funds.

To better balance development and risk management, the ministry will promote the prevention and resolution of local government debt risks, accelerate the implementation of a package of related measures and push for the reform and transformation of local government financing platforms.

京公網(wǎng)安備 11010202009201號

京公網(wǎng)安備 11010202009201號