China further reduced its holdings of U.S. Treasury debt in February to the lowest level in nearly 13 years, as other foreign holders cut their holdings by 4.7 percent year-on-year to $7.34 trillion, data from the U.S. Treasury Department showed.

Experts noted that the Chinese mainland's cut aims to further diversify its allocation of foreign exchange reserves, which is conducive to bolstering economic security amid external risks.

In February, total foreign holdings of U.S. Treasury debt stood at $7.34 trillion, down from $7.4 trillion in January, while lower than $7.7 trillion in February 2022, per data from the U.S. Treasury Department released on Monday local time.

Chinese mainland's holdings fell to $848.8 billion in February from $859.4 billion in January. The figure stood at $1.03 trillion at the same time last year.

Japan, the largest foreign holder of U.S. Treasury debt, cut its holdings in February to $1.09 trillion from $1.1 trillion a month earlier.

Some foreign holders, including China, have been diversifying their foreign exchange reserves, Xi Junyang, a professor at the Shanghai University of Finance and Economics, told the Global Times on Tuesday.

Wang Youxin, a researcher with the Institute of International Finance at the Bank of China, said earlier that a more diversified allocation of foreign exchange reserves is conducive to enhancing national economic and financial security amid intensifying geopolitical competition, per a report from chinanews.com.

Experts also highlighted the strengthened internationalization of the yuan and the increasing application scenarios for yuan-based settlement as other reasons for China's continuous reduction in holdings amid the global de-dollarization trend.

China has been promoting the internationalization of the yuan, aiming to use it for more foreign economic activity instead of the U.S. dollar, and the yuan's global role is already increasing, Xi added.

The yuan has become a relatively stable currency for global investors while China remains a top investment destination, Dong Dengxin, director of the Finance and Securities Institute at the Wuhan University of Science and Technology, told the Global Times on Tuesday.

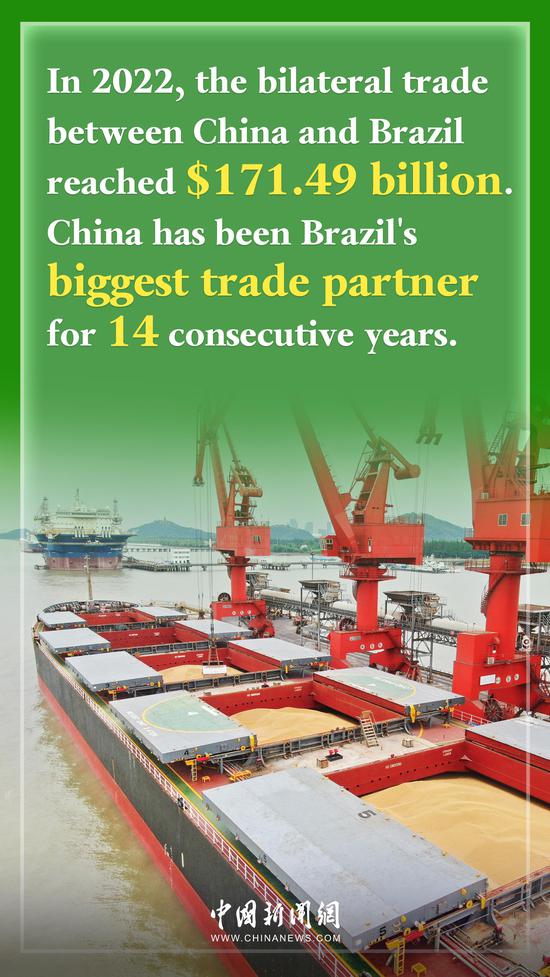

Last week, China's Industrial and Commercial Bank of China processed the first cross-border yuan settlement in Brazil at its local branch. The nation also completed first purchase of liquefied natural gas sourced from the United Arab Emirates using cross-border yuan settlement.

京公網(wǎng)安備 11010202009201號

京公網(wǎng)安備 11010202009201號