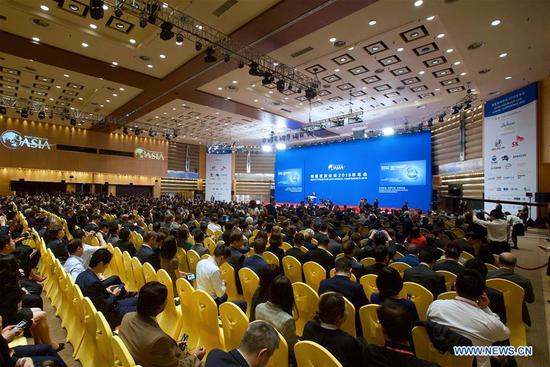

Zhu Min, chair of the National Institute of Financial Research at Tsinghua University (right), speaks during a panel discussion at the 2019 Boao Forum for Asia Annual Conference in Boao, Hainan province, on Friday. (Photo by Wang Zhuangfei / China Daily)

China can push forward deleveraging and deal with short-term downside pressure in a coordinated way to ensure sustainable and high-quality economic growth, experts said on Friday.

"Deleveraging does not necessarily lead to slower economic growth. It depends on which approach we choose to lower the leverage," said Hu Xiaolian, chair of the Export-Import Bank of China at the Boao Forum for Asia, which concluded on Friday.

As China's deleveraging moves support supply-side structural reforms, deleveraging and economic growth actually go hand in hand in many aspects, Hu said.

Reducing the debt ratio of State-owned enterprises, for example, entails reforms to strengthen corporate governance and higher efficiency, she said, adding that China's efforts to develop a stronger capital market will not only reduce the corporate debt level by increasing equity financing but also contribute to economic growth.

On the other hand, policies to stabilize growth also contribute to deleveraging, Hu said.

"The large-scale reduction of taxes and fees could efficiently reduce burdens on enterprises and strengthen their ability to repay debts and absorb equity financing," she said.

Zhu Min, chair of the National Institute of Financial Research at Tsinghua University, said it is clear that China will "move more on fiscal policy than monetary policy" to offset short-term economic challenges.

This year's tax and fee cut on enterprises-worth nearly 2 trillion yuan ($297.8 billion)-is "really encouraging", which will improve their productivity and efficiency, said Zhu, a former deputy managing director of the International Monetary Fund.

The debt level, especially for State-owned enterprises, is still high, Zhu said, making it necessary to continue deleveraging to contain risks and achieve sustainable growth.

In 2018, the leverage ratio in the real economy declined to 243.7 percent, 0.3 percentage points lower than in 2017, while the outstanding debt of the State-owned sector grew by 16 percent, according to the Chinese Academy of Social Sciences.

This year's Government Work Report said China will adopt a prudent monetary policy to keep liquidity "reasonably ample" and avoid a deluge of stimulus. The government has also pledged to continue structural deleveraging to forestall major risks.

Zhu added that this year's increment in the local government bond quota should not be understood as a new leveraging move. "We have to consider liquidity and provide liquidity and space for the local bond market," Zhu said.

China has set the local government bond quota at 2.15 trillion yuan, up nearly 60 percent year-on-year, mainly to support major projects already underway and to address weak links.

Xuan Changneng, deputy head of the State Administration of Foreign Exchange, said, "China has ample room to maneuver and take measures toward deleveraging."

That conclusion is based on the debt structure and interest rate level, he said.

"When we're talking about deleveraging and maintaining stable growth, I think the focus for several years has been on quality growth, not just any growth," he said.