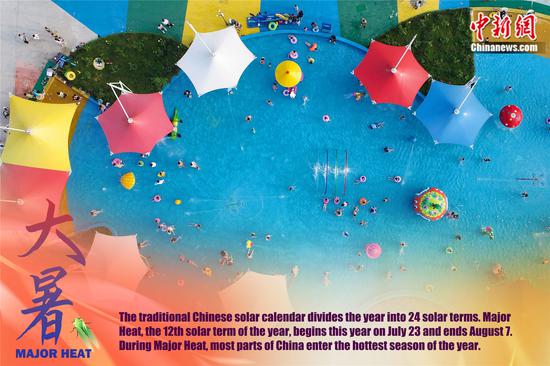

Visitors get to know information of a commercial housing project during a real estate trade fair in Taizhou, Zhejiang province, on June 21. (PAN KANJUN/FOR CHINA DAILY)

Loan extensions, adjusted repayments will help developers deliver projects on time

China recently extended the timelines for a basket of financial policies supporting the real estate market.

The nation has, over the past two years, rolled out a number of measures to underpin and stabilize the real estate sector. These include greater financing support for realty developers and improved tax breaks for used homes.

Experts say the latest step — announced by the People's Bank of China, the country's central bank, and the National Financial Regulatory Administration, the financial sector regulator — will alleviate the concerns of financial institutions with regard to the loan repayment ability of home developers and boost consumer confidence.

Part of the 16-item guideline put in place last year will now extend till Dec 31, 2024. This means, financial institutions will get a fillip to negotiate with real estate enterprises on outstanding loans, such as for housing development, in a market-friendly way, and ensure creditors' rights.

Financial institutions have been urged to assist developers in the timely delivery of housing projects by extending or adjusting loan repayments. Loans of developers maturing before Dec 31, 2024, will be extended for another year.

Meanwhile, commercial banks are required to provide financing to projects supported by special loans, with the loan's risk classification remaining unchanged.

If any nonperforming loan arises from the newly issued packaged loan, the relevant institutions and personnel will be exempt from liability under the purview of due diligence.

"The policy extension will stabilize the real estate market in the latter half of the year," said Tian Lihui, director of the Institute of Finance and Development at Nankai University.

"Such a move will give financial institutions the confidence to lend to housing developers. As overall economic growth faces challenges, banks are widely concerned about lending to real estate businesses. Some developers have also seen loans being withdrawn," he said. "In such a context, we believe the extension of support will help guarantee smooth delivery of new and ongoing housing projects, and therefore ensure livelihoods."

The policy support will also better support reasonable demand for individual home loans, he added.

The country's investment in the real estate sector slid by 7.9 percent in the first six months from a year ago, according to the latest data from the National Bureau of Statistics. This compares with a 7.2 percent slide in the first five months from the corresponding period of last year.

NBS said the property sector will "gradually stabilize as the broader economy recovers, and is shifting from high-speed development to stable development in the medium to long term".

A number of reasons are leading to the weak recovery, said Tian.

These include the current oversupply in real estate, slowdown of growth in household income, lack of consumer demand for home purchases, and lending restrictions in certain areas.

"Homebuyers' market expectation is key for future recovery," he added.

Going forward, policy efforts to support home upgraders, such as easing loan restrictions and lowering interest rates for property loans, are urgently needed, said Dong Ximiao, chief researcher at Merchants Union Consumer Finance Co.

京公網(wǎng)安備 11010202009201號(hào)

京公網(wǎng)安備 11010202009201號(hào)