A clerk counts cash at a bank outlet in Hai'an county, Jiangsu province. (Photo/China Daily)

The Bond Connect program has witnessed a 30-fold growth in trading volume since its launch more than half a decade ago as yuan-denominated bonds are increasingly popular among global investors due to their superior returns and diversification benefits.

The comment was made by senior officials from the People's Bank of China — the country's central bank — and the China Foreign Exchange Trade System during the Bond Connect Anniversary Summit 2023 held in Hong Kong on Tuesday to celebrate the sixth anniversary of the program.

Gao Fei, deputy director of the PBOC's Financial Market Department, said the return rate on investing in medium-and long-term Chinese government bonds outperforms investments in bonds issued by other governments.

Gao cited data from FTSE Russell showing the return rate of Chinese government bonds in 2022 ranked tops globally.

"If denominated in the local currency of each country, the return rates of holding short-term, medium-and long-term Chinese government bonds last year were 2.6 percent, 2.8 percent and 5.8 percent, respectively, which are significantly higher than that of other market government bonds with the same maturity," Gao said.

"Moreover, Chinese government bonds are the only government bonds with positive investment returns in all maturities," he added. Even taking into account exchange rate fluctuations and inflation, Gao said, the real investment yield of renminbi-denominated bonds is still relatively high.

"From the perspective of hedging, this function of renminbi-denominated bonds has also been continuously enhanced, and has gradually become a totally safe asset," Gao added.

"We believe that as China's various policies and measures take effect, overall economic operations pick up — alongside the diversification value brought by competitive real interest rates and low correlation of renminbi-denominated bonds with other asset classes — these factors will continue to bring opportunities for overseas institutions," said Zhang Yi, president of the China Foreign Exchange Trade System and chairperson of Bond Connect Company.

Bond Connect is a platform that enables foreign investors to invest in the mainland's interbank bond market via Hong Kong for the first time. It was officially launched in July 2017 on the 20th anniversary of Hong Kong's return to the motherland. The program extended the southbound connect program in September 2021, allowing mainland investors to invest in overseas bonds via Hong Kong, thus realizing "North-South two-way" interconnectivity of the bond market.

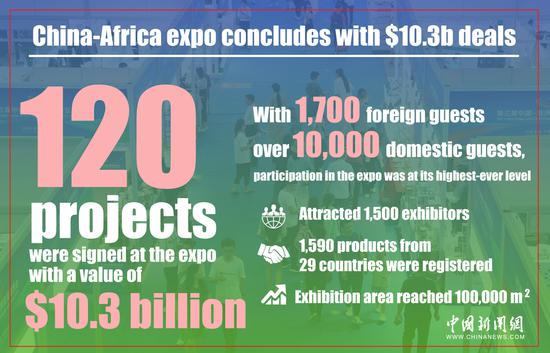

According to Hong Kong Financial Secretary Paul Chan Mo-po, the total amount of mainland bonds held by overseas institutions through the Bond Connect program exceeds 3.1 trillion yuan ($429.8 billion). The trading volume of the Bond Connect program jumped from 31 billion yuan in the first month of its launch in 2017 to more than 970 billion yuan in May of this year, a more than 30-fold increase. The trading volume of northbound trading accounted for 70 percent of the overall trading volume of foreign investors in the mainland interbank bond market.

"Under 'one country, two systems', we have been playing the role of a 'firewall' and 'experimental field' at different stages of the country's financial reform and opening-up, contributing to the development and orderly opening of the mainland's financial market," Chan said at the summit.

He said that the interconnection mechanism in bond trading has created an onshore transaction model with risk-control features and unprecedented cross-border market liquidity, contributing to the orderly opening of the country's financial market and the steady and prudent advancement of the internationalization of the renminbi.

"Looking ahead, Hong Kong will continue to strengthen its connectivity and interaction with the mainland capital markets, further strengthen Hong Kong's status as a global offshore renminbi business hub and an international risk management center, and actively contribute to the country's development," Chan added.

京公網安備 11010202009201號

京公網安備 11010202009201號