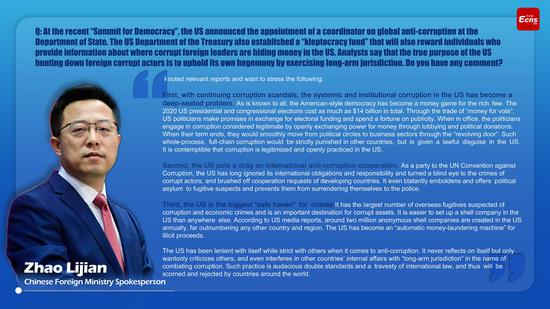

People show their e-CNY digital wallets after being gifted with digital red envelopes from the Chengdu municipal government and e-commerce giant JD in March. (Photo by He Haiyang/For China Daily)

More than 140m personal e-CNY accounts created while value of transactions hits 62b yuan

Successfully riding the digitalization tide in 2021 is the Chinese yuan, which is attracting more users to its digital version.

According to the People's Bank of China, the country's central bank, more than 140 million personal digital wallets for e-CNY have been created and another 10 million company digital wallets were opened as of Oct 22. More than 150 million transactions have been made via digital wallets, with the total transaction value approaching 62 billion yuan ($9.73 billion).

Meanwhile, over 3.5 million application scenarios for e-CNY accounts have been explored. A growing number of brick-and-mortar stores in Beijing and Shanghai, as well as online retailers like JD, are getting themselves connected to e-CNY payments.

The proliferation of digital wallets indicates a much bigger market. HuaAn Securities expects that software and hardware upgrades related to the application of e-CNY can be translated into a market value amounting to over 140 billion yuan, of which 5.1 billion yuan is contributed by transformation of banks' core systems, 50.7 billion yuan from ATM upgrades and 19.2 billion yuan derived from improved card readers.

Mu Changchun, head of the PBOC's Digital Currency Research Institute, said substantial progress in the application of digital yuan has been made in the second half. The number of newly opened personal digital wallets has increased by 6.7 times in less than four months since the end of June, which is one snapshot of the explosive expansion of the e-CNY market.

The progress was not realized overnight. As early as 2014, a special team has been set up to study the framework, key technologies and circulation of the e-CNY. Mu's institute was founded two years later to build the first prototype of the digital yuan. As approved by the State Council, the PBOC launched development of the e-CNY by working with commercial institutions in 2017. Top-layer design, standards, functions and joint tests of the e-CNY were finished in early 2020.

In a white paper released by the PBOC in late July, the central bank laid out the background and purpose of introducing the e-CNY, which included the country's transition toward a digital economy, the decline of the use of cash, the rapid rise of cryptocurrencies and the development of central bank digital currencies-or CBDC-around the world.

Similarly, the Bank for International Settlements, the International Monetary Fund and the World Bank made a joint call in early July for global cooperation in the development of CBDC to address the potential macro-financial consequences that CBDC might cause.

While addressing to the 30th Anniversary Conference of the Bank of Finland Institute for Emerging Economics in early November, Yi Gang, governor of the People's Bank of China, said that the design and use of digital yuan should be further advanced.

Mu of the Digital Currency Research Institute said more diversified smart and tailor-made digital yuan wallets will be introduced. Security and risk management mechanisms should be optimized by introducing independent supervision measures over the use of e-CNY, Mu added.

Meanwhile, the digital yuan will facilitate the development of green finance and help achieve China's goal of reaching carbon neutrality.

Third-party services provider Meituan started a campaign in nine Chinese cities in September by supplying free bike-sharing services to people using e-CNY. In late December, the industry giant moved ahead by granting e-CNY bonuses to those who refrain from using disposable dishware and bring their own bags when shopping.

"Faced with the issues of our time such as peaking carbon emissions by 2030 and realizing carbon neutrality by 2060, we think e-CNY is one of the best solutions to address such issues," said Bao Ta, vice-president of Meituan.

Cheng Shi, chief economist at Hong Kong-based ICBC International, said the digital yuan will help remove obstacles regarding the internationalization of the renminbi.

The e-CNY not only helps to improve payment efficiency, but also lowers intermediaries' exposure to credit and liquidity risks, Cheng said.

"Given China's competitive edge in digital economy, the renminbi will seize the best opportunity to become a global payment currency by combining payment and multiple frontier digital services. This will fundamentally enhance the renminbi's global competitiveness and lower the renminbi's reliance on the global banking system dominated by the US dollar," he added.

京公網安備 11010202009201號

京公網安備 11010202009201號