The impact of the novel coronavirus disease (COVID-19) on the asset quality and credit risks of Chinese banks is limited and short-lived, an analyst said.

As China implements pro-growth policies, the fundamentals of the financial sector will gradually improve, supporting the stable growth of banks, especially large-scale ones, said Tang Shengbo, head of China financial research for Nomura, a financial service firm.

The country's lenders reported better-than-expected first quarter results, Tang noted, adding that the adverse effects of the epidemic have not yet fully been reflected in Q1 results, and are likely to pressure banks' earnings in the second and third quarters.

Tang expected the sector to bottom out by Q3 as the economy gradually stabilizes.

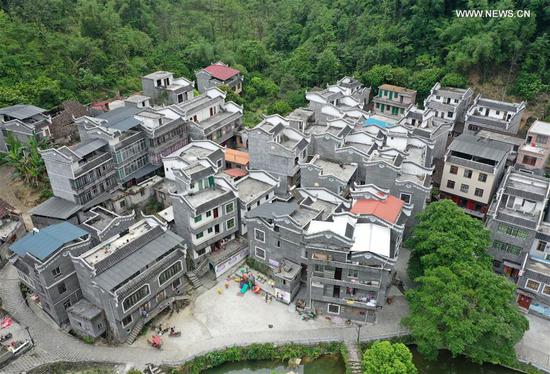

China has been leveraging a series of monetary and fiscal measures to channel much-needed funds into the coronavirus-hit companies while keeping financial risks under control.

The country's macro leverage ratio has increased in the first quarter as a result of counter-cyclical policies aimed at supporting the resumption of work by companies, but the hike is only temporary and will eventually trend down after companies resume operations, the central bank said earlier in May.