Chinese financial assets are becoming an indispensable part of global investors' holdings, as economic upgrade has nurtured new opportunities and the nation has opened wider to foreign investment, officials and experts said.

Foreign investors have continuously increased Chinese stock and bond assets holdings over the course of this year, with the stock market having attracted more than 240 billion yuan ($34 billion) in foreign capital, according to China's top securities regulator on Saturday.

This development attested to global investors' confidence in China's capital market reforms and economic prospects, China Securities Regulatory Commission Vice-Chairman Li Chao said at a forum.

The commission announced nine measures to further open the capital markets in June, and now six of them have taken effect, Li said-they include relaxing foreign access to fund custodian services, expanding trials of the H-share full circulation program to the whole market and giving foreign capital wider access to mainland-listed futures.

Next, the commission will step up efforts to refine qualified foreign institutional investors programs to expand market access and broaden access channels to exchange bond markets for foreign capital, Li said.

"Not only is China now more open to investment, it is also the source of new business opportunities-driven particularly by a growing middle class and domestic consumption," said a recent BlackRock report, which found that China represents "an opportunity too big to ignore" for global investors.

"China has many world-class investment opportunities. In many cases we don't need to look abroad for shares with high-growth potential because we can reach them domestically," said Iris Pang, China director and economist of ING, a Netherlands-based global financial institution.

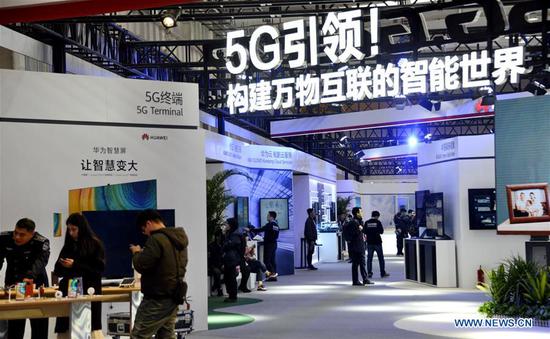

Pang told China Daily she was especially upbeat about listed firms that could contribute to or benefit from China's development of 5G, which is set to be major growth driver in 2020, while calling for reform measures to align the domestic bond rating system with global standards.

Capital market reform efforts will focus on making the markets more inclusive to different firms and furthering market-oriented improvement in fundamental institutions, said Li from CSRC.