Experts warn it would damage small companies as consumers pay for the hit

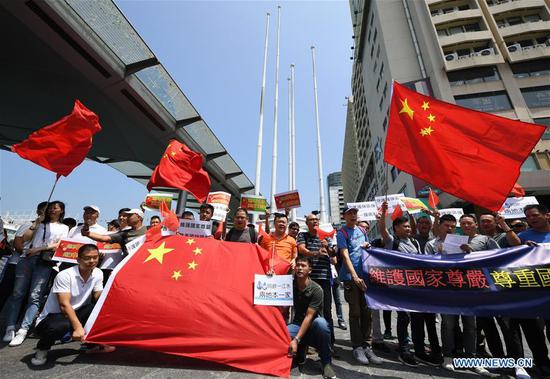

For the U.S. toy industry, President Donald Trump's threatened 10 percent tariff on an additional $300 billion worth of Chinese goods starting from Sept 1 would come during the peak holiday shipping month, when many Chinese toy manufacturers send their products to the United States.

Though some U.S. toy companies have come up with contingency plans, like lowering their reliance on manufacturing in China, many will still make the U.S. consumer pay more if the tariffs hit.

"Hasbro will have no choice but to pass along the increased costs to our U.S. customers," said Brian Goldner, CEO of toy company Hasbro. He said the Pawtucket, Rhode Islandbased company, the maker of popular products such as Monopoly and GI Joe, was working to reduce its reliance on manufacturers in China, but he also said it has built up extra inventory, incurring additional storage costs, as it braces for tariffs.

It's hard to tell whether companies will alleviate the impact of a new tariff before the holiday season arrives, Linda Bolton Weiser, a senior research analyst at financial services firm D.A. Davidson Companies, told China Daily.

But she said that they will try to find alternative suppliers, and work with their procurement teams to optimize product mix and sourcing options. Many also will continue to move manufacturing from China to countries like Vietnam.

"They will do as much as they can to mitigate or offset the impact of the tariffs through all the different measures, but it's uncertain now to what extent they will be able to either partially or fully offset the impact," Weiser said.

"The good news is that the tariff is only 10 percent, so a product-price increase of 5 percent is needed to keep gross profit dollars unchanged. However, the gross margin would decline," she said.

Reeling industry

Around 85 percent of the toys sold in the U.S. are manufactured in China. Major players, such as Hasbro and El Segundo, California-based Mattel, will bear less of a tariff burden then the rest of the industry because only two-thirds of their products are manufactured in China. For many smaller companies, however, almost all of their products are made in China, Weiser said.

The U.S. toy industry is still reeling from last year's liquidation of the major retailer chain Toys R Us. After four straight years of growth, toy sales in the U.S. in 2018 fell 2 percent to $21.6 billion, from $22 billion in 2017, according to market researcher NPD Group.

"This is supposed to be the year of recovery. To continue to play this guessing game of whether there's going to be a cost increase, how much that cost increase is going to be, when is it going to go into effect, has been a really troubling environment for companies to try to make business decisions that are long term," said Rebecca Mond, vice-president of federal government affairs at the New York-based Toy Association.

The U.S. toy industry supports more than 680,000 U.S. workers, and it accounts for $110 billion in economic value, according to data from the association.

Overall, tariffs on the toy industry would reduce its economic impact on the U.S. economy by approximately 10 percent, or $10.8 billion.

The new tariff would be in addition to the 25 percent tariff that Trump levied on a separate $250 billion worth of Chinese imports over the past year.

While the previous tariffs affect inputs, components and raw materials for domestic toy production, the latest tariff will likely hit finished toys and other toy-related items not yet subject to tariffs.

With the tariffs implemented, the retailers would want to avoid paying the tariffs themselves, which would in turn force toymakers like Hasbro or Mattel to bring in more imports, Weiser said.

"It changes the nature of the business, and it changes the makeup of the revenue, so it's going to put more burden for more shipping capacity onto the toymaker," she said.