Investors are looking for fresh cues on possible monetary policy moves, amid growing concerns that lingering trade tensions will prompt policymakers to consider more easing measures.

A regular monetary policy committee meeting of the People's Bank of China, the central bank, has led to discussions on possible monetary policy adjustments - whether it will follow the other major central banks to ease policy, especially through cutting the long-term unchanged benchmarked interest rates.

"Once the United States Federal Reserve cuts policy rates at the end of July and economic growth downside risks increase, China may follow the Fed in cutting interest rates, if there is no major change in the inflation levels," said Li Chao, chief researcher of Huatai Securities.

The renminbi will, however, face pressure, even against a weaker US dollar, if the central bank eases the monetary policy further, economists said.

A statement on the PBOC website said that the renminbi exchange rate has been stable until now. The currency will have stronger capacity to resist external shocks due to the enhanced economic resilience, it said.

But monetary authorities are keeping a close watch on changes in the global and domestic economic, financing situation. The PBOC reaffirmed that necessary and innovative monetary policy tools will be used to counter financial stress and keep liquidity at a reasonably ample level.

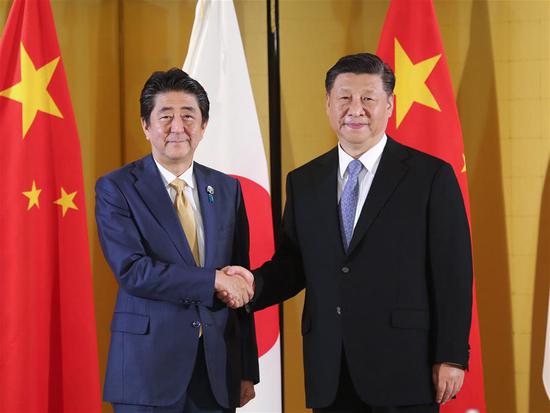

Before the ongoing G20 summit in Osaka, Japan, the US Federal Reserve sent a signal that it might cut the policy rates later this year as global economic uncertainties are rising and domestic inflationary pressures are subdued. The European Central Bank President Mario Draghi has also indicated in recent speeches that the bank was planning to further ease monetary policy.

"If the monetary easing continues, it will create more liquidity, and I am very much concerned about that," Naoyuki Yoshino, dean and CEO of the Asian Development Bank Institute told China Daily in Osaka.

The relatively lower interest rates in the US and the EU have triggered capital inflows into Asian countries. In order to maintain stable capital inflows, the rest of the world has to cut interest rates, if the Fed cuts the policy rate afterward, said Yoshino, citing Japan's recent monetary easing as an example.

Chinese leaders have reiterated on different occasions that the country will avoid beggar-thy-neighbor policies and not use the exchange rate as a weapon to solve trade issues. Instead efforts will be more on enhancing the macroeconomic policy coordination with other countries.

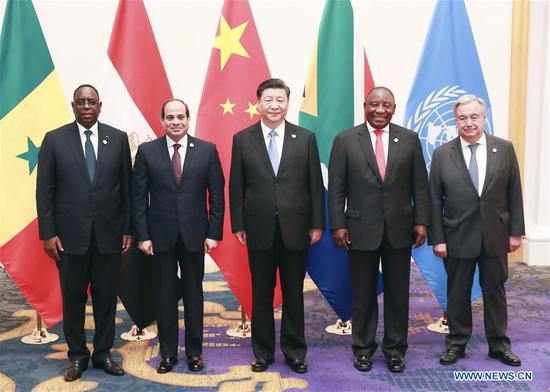

Chen Yulu, vice-governor of the PBOC, said that China expects the G20 summit to deliver clear and positive signals to improve macroeconomic policy coordination, and stabilize the global financial system with fiscal, monetary and structural policy tools.

The monetary policy committee said it would strive to maintain a "prudent" policy, to avoid aggressive monetary easing and focus on supporting the real economy. It also pledged to maintain the renminbi exchange rate at a reasonably stable equilibrium.

Whether the PBOC will follow the US Fed on rate cuts is especially relevant due to the escalating China-US trade tensions, and it has been a major cause for the growing uncertainties in the growth outlooks of both economies, said Lu Ting, chief economist of Nomura Securities, a Tokyo-based brokerage.

As China is in a prolonged transformation of its interest rate regime, the likelihood of the PBOC cutting the benchmark lending and deposit rates is quite small, but it may lower some quasi policy rates, such as the reverse repo rate, the medium-term lending facility rate and the standing lending facility rate if the Fed cuts rates, said Lu.