China's A-share market is showing signs of a slow recovery, with the Shanghai Composite Index rising 0.56 percent to close at 2610.51 points on Monday and the Shenzhen Component Index gaining 0.59 percent to close at 7626.24 points.

According to Shanghai-based market information provider Wind Info, the combined trading value in Shanghai and Shenzhen topped 300 billion yuan ($44 billion) on Monday. The stock prices of nearly 40 companies hit the daily increase limit of 10 percent.

Industries including telecommunication, winemaking, ports, fertilizer, power supply, home appliances, papermaking and pharmaceuticals led the increase.

Yang Delong, chief economist at Shenzhen-based First Seafront Fund, said the economic statistics released on Monday helped to dispel investors' concerns over the market. The stock market in the United States has reported gains for 11 trading days in a row, which helped to increase the risk appetite in the global capital market, he said.

Analysts from Shenwan Hongyuan Securities wrote in a note that the economic growth slowdown is not worse than expected based on the recently released figures. Given the sluggish performance in the previous weeks, the market had already reached its bottom and was ready for a rebound. Meanwhile, the easing downward pressure from overseas markets and the improved liquidity in the domestic stock market will help the benchmark indexes to continue to climb.

Li Menghai, a fund manager at Invesco Great Wall Fund Management, said small and medium-sized enterprises will probably seek more room for growth in the next two to three years as the market has shown signs of bottoming out.

Against this backdrop, Li Shaojun, a strategist at Guotai Junan Securities, suggested investors look at undervalued companies in the banking, property, gold, public facilities, and agriculture sectors, which will be defensive in the long term.

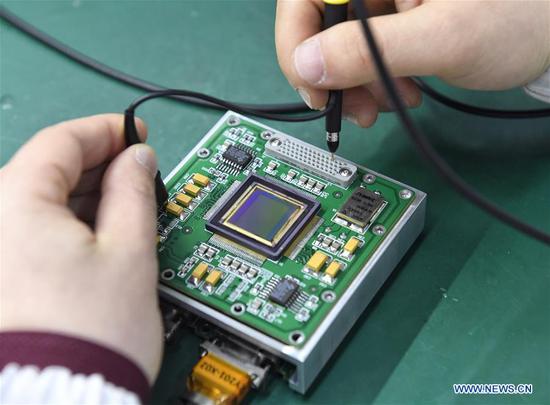

There will also be opportunities in manufacturing companies with expertise in technology, media and telecom, especially those supported by strong fiscal numbers, Li said.

Companies related to both economic transformation and new forms of infrastructure will also indicate growth, including 5G, artificial intelligence, industrial internet and the internet of things, he said.