(ECNS) -- In a significant shift, global financial institutions are showing renewed confidence in Chinese assets, with major banks and investors increasingly bullish on China's stock market.

Deutsche Bank predicts that the valuation discount on Chinese equities will soon disappear, while Morgan Stanley forecasts the MSCI China Index will surge to 77 by the end of 2025. Similarly, Bank of America has advised investors to go long on Chinese stocks.

This wave of optimism is backed by hard data. Goldman Sachs reports that global hedge funds have been aggressively buying Chinese stocks for most of the year.

In the past month alone, global hedge funds have driven a staggering $1.3 trillion increase in the total market capitalization of China’s onshore and offshore markets.

Clearly, the world is reassessing the true value of Chinese assets.

The catalysts behind the shift

Several factors are driving this renewed investor interest.

Tian Lihui, a finance professor at Nankai University, attributes this trend to China’s technological rise, economic resilience, government policy support, and evolving global dynamics.

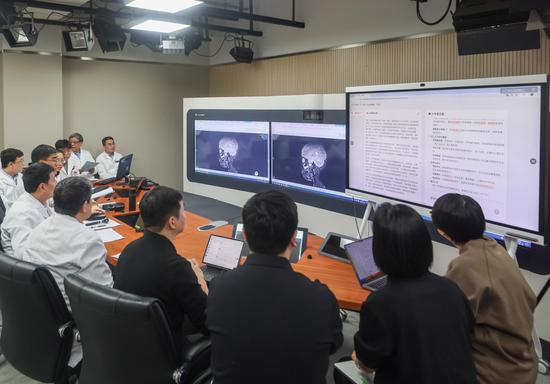

A prime example of China’s technological prowess is DeepSeek, a groundbreaking AI innovation that has reshaped the artificial intelligence landscape.

Historically, global capital has favored technology stocks—just look at how the "Magnificent Seven" tech giants dominated U.S. markets in 2024.

DeepSeek's success underscores China’s ability to pioneer technological breakthroughs from the ground up.

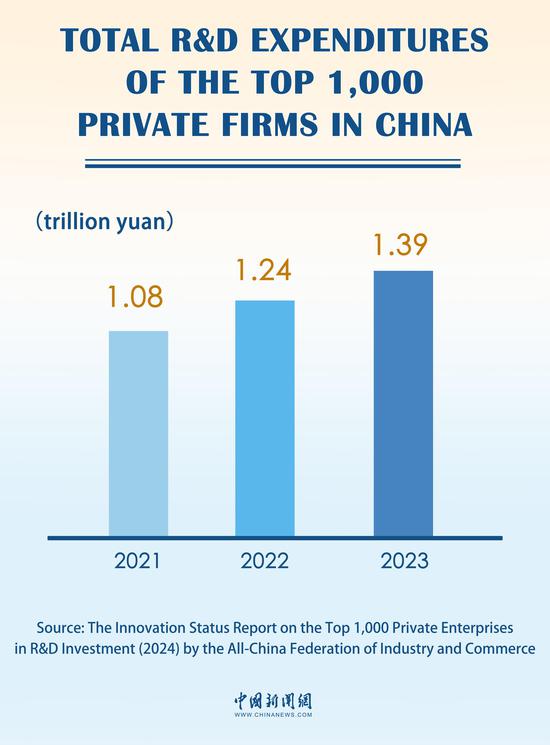

But China’s innovation extends far beyond AI.

Advancements in brain-computer interfaces, humanoid robotics, and autonomous driving continue to emerge, reshaping industries and strengthening investor confidence.

Strong economic fundamentals reshape investment logic

China’s stable economic performance amid global uncertainty is another major factor behind the renewed enthusiasm from investors. In 2024, China's GDP exceeded 130 trillion yuan (about $18 trillion) for the first time, with a 5% growth rate positioning it among the world’s fastest-growing major economies.

However, it's not just the scale of growth that matters. China’s strategic focus on advanced manufacturing and the development of high-quality productive forces is accelerating, while traditional industries are undergoing revitalization.

Peter Milliken, Deutsche Bank's APAC head of company research, highlighted China’s growing dominance in high-value sectors and supply chains, which are expanding at an unprecedented pace.

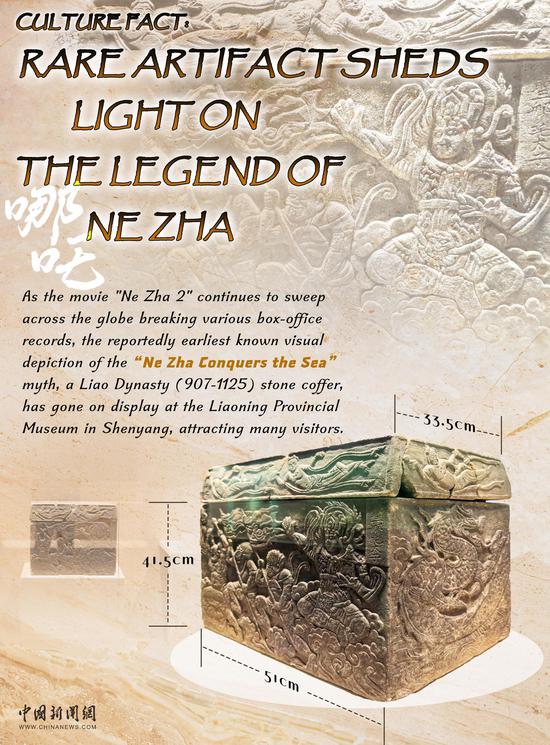

Meanwhile, China’s consumer market remains a powerful force. The recent Chinese New Year holiday saw record-breaking tourism figures and box office earnings, proving that domestic consumption continues to be a key driver of economic vitality.

Policy support and global capital flows

China’s proactive policy measures have also played a crucial role in stabilizing and revitalizing its financial markets.

Since September 2024, a series of strategic policies have been introduced, including swap facilities for securities, funds, and insurance companies, as well as stock repurchase refinancing tools. These initiatives have bolstered market confidence both domestically and internationally.

The impact is clear: global capital is shifting eastward.

This trend will have far-reaching implications, strengthening China’s role in global markets. Increased international inflows into China’s capital markets will enhance the global integration of A-shares, while rising investor confidence in Chinese enterprises will drive economic transformation and industrial upgrades.

With sustained economic momentum, accelerating technological breakthroughs, and a favorable investment environment, China’s capital markets are well-positioned for long-term growth.

As global investors diversify their portfolios, betting on China may no longer be just an option—it could be the smartest move for the future.

京公網安備 11010202009201號

京公網安備 11010202009201號