(ECNS) -- Transactions under the Northbound Swap Connect, which allows overseas investors from Hong Kong Special Administrative Region (HKSAR) and other countries and regions to participate in the Chinese mainland interbank financial derivatives market, will officially begin on May 15, says the People’s Bank of China (PBoC), the central bank of China.

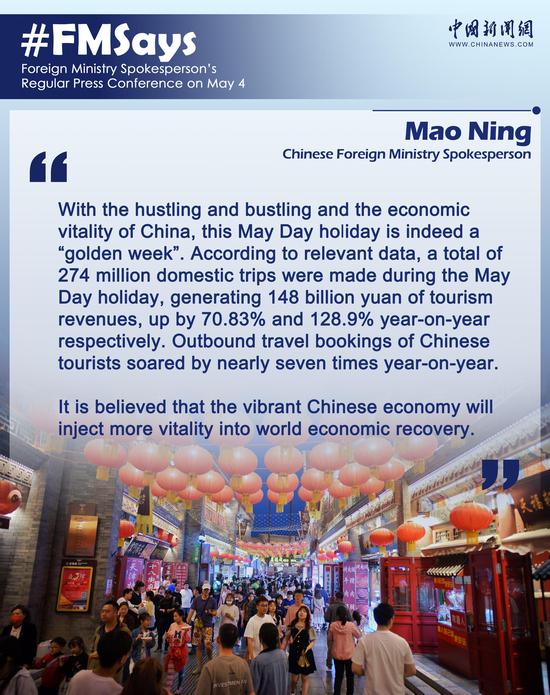

Industry insiders said the launch of the Swap Connect is a milestone, which means the Chinese mainland’s bond market extends to the derivatives field. This will further release the potential of foreign investors to participate in China’s bond market and attract more foreign capital inflows. In the long run, the Chinese economy will steadily turn for the better and its financial market will gradually open, making RMB assets increasingly attractive.

According to the PBoC, at the initial stage, eligible investment products will include interest rate swap contracts. The quotation, transaction and settlement currency will be in renminbi (RMB).

As for the trading quota, at the initial stage, the framework will be subject to a daily net trading quota of 20 billion yuan ($2.89 billion) and a clearing quota of four billion yuan, the central bank said, adding that it will adjust the quotas based on the market.

Zhang Jinqiu, vice president of HSBC Bank (China) and co-director of its Global Capital Markets, said that in recent years, the continuous opening of China's bond market has attracted many foreign investors, and the scale of their holdings of Chinese bonds has been expanding, followed by the growing demand of foreign investors for tools to hedge interest rate risks. This creates an appropriate opportunity for the launch of the Northbound Swap Connect.

China is the second largest bond market in the world. Official data shows that bonds in China's interbank market held by overseas institutions stood at 3.4 trillion yuan as of the end of January, accounting for 2.3 percent of the total custody of the country's interbank bond market.

“Many investors have inquired about the Northbound Swap Connect and hope to engage in transactions under the framework as soon as possible,” said Xu Zhaoting, China Head of Global Emerging Market Trading at Deutsche Bank.

“The active participation of global investors shows their confidence in the connectivity of the Chinese mainland, HKSAR, and the world in financial market infrastructure, especially in the connectivity of the derivatives market, which is more complex,” he added.

The vice president of HSBC Bank (China) said in the future, with the development of the Northbound Swap Connect, China’s bond market will further connect with the international market and attract more foreign investment.

This not only enables international investors to optimize asset allocation by investing in China’s bond market, but also helps to further diversify the investor structure in China’s bond market, Zhang added.

京公網(wǎng)安備 11010202009201號(hào)

京公網(wǎng)安備 11010202009201號(hào)