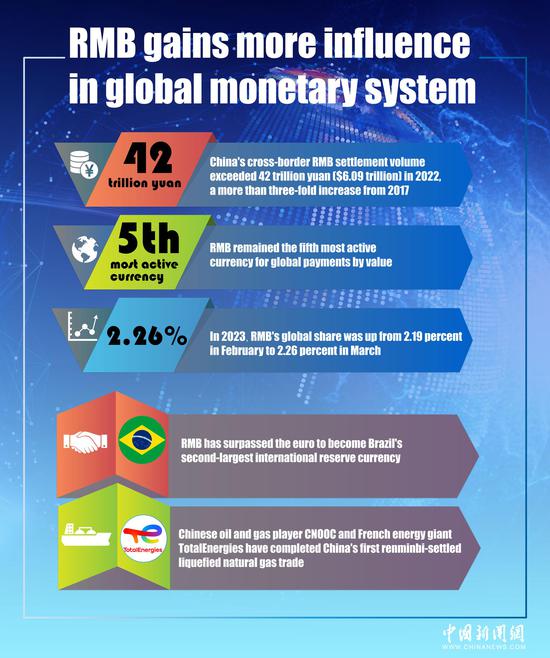

(ECNS) -- Bangladesh and Russia have agreed to use the Chinese yuan, or RMB, to settle payment for a nuclear plant Moscow is building in the South Asian country, Reuters reported Monday, which will further strengthen the trend of de-dollarization trend worldwide.

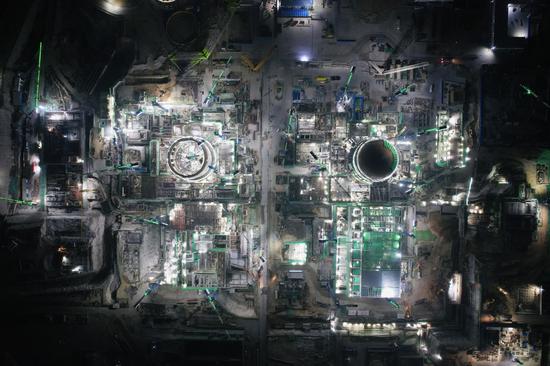

Bangladesh is constructing the first of two nuclear power plants in cooperation with Russia's state-owned atomic company Rosatom. The project is worth $12.65 billion, 90 percent of which is financed through a Russian loan repayable within 28 years, with a 10-year grace period, according to Reuters.

Some major economies, both in developed countries and emerging markets, are striving to ditch the U.S. dollar through innovating cross-border payment and settlement mechanisms, signing bilateral currency agreements, and promoting the diversification of currencies.

In South Asia, India and Malaysia have agreed to use Indian Rupees for trade settlement.

Brazil and Argentina, the two largest economies in South America, announced in January that they intended to launch a currency union called the “sur” (the south), which will drive trade in the region and rely less on the U.S. dollar.

Russia, Iran, Türkiye, and other countries are promoting settlement via their own currencies.

International media outlets paid attention to the trend of de-dollarization. “The dollar is facing a challenge to its status on multiple fronts,” said U.S. media outlet Business Insider, citing an analysis by Deutsche Bank.

Turkish media outlet TRT World pointed out that political disputes and financial crises are the most common reasons why several governments are reducing their dependency on the U.S. dollar.

"The U.S. often turns a blind eye to the United Nations charter and imposes unilateral embargoes and threatens other nations to follow the suit. This ironfisted approach has made the U.S. the top sanctions-imposing nation in the world," TRT said in a report released at the beginning of April.

Moreover, the debt accumulated by the U.S. government has left markets vulnerable to major financial disruptions. “As a result, many nations have taken the path of "de-dollarization" to safeguard their economies from further damage.”

The rejection of the dollar in global economic relations is an irreversible process explained in particular by its use as an instrument of pressure for other countries, observer and geopolitical expert Renaud Girard said in his op-ed in Le Figaro.

京公網安備 11010202009201號

京公網安備 11010202009201號