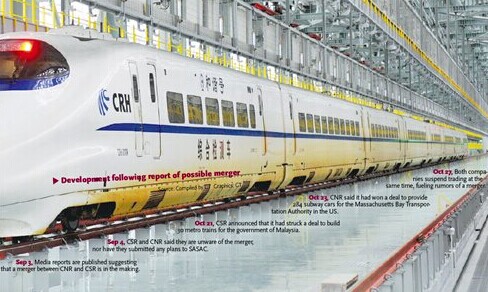

China's securities watchdog has approved a merger deal between China South Locomotive & Rolling Stock Corporation Limited (CSR) and China North Locomotive and Rolling Stock Industry (Group) Corporation (CNR), with CSR planning to issue 11.14 billion new shares for the acquisition of CNR. (File photo)

(ECNS) -- China's securities watchdog has approved a merger deal between China South Locomotive & Rolling Stock Corporation Limited (CSR) and China North Locomotive and Rolling Stock Industry (Group) Corporation (CNR), with CSR planning to issue 11.14 billion new shares for the acquisition of CNR, ce.cn reports.

The approval, issued by the China Securities Regulatory Commission, will be valid for 12 months.

At Tuesday's closing, the market value of CSR topped 430 billion yuan ($70 billion) while that of CNR exceeded 400 billion yuan. After the merger of the two high-speed train manufacturers, with combined capitalization expected to hit more than 840 billion yuan, the new company is set to become one of the largest listed on the A-share market in terms of market value.

In 2000, China National Railway Locomotive & Rolling Stock Industry Corp was split into CSR and CNR, in order to create a geographically-based competition mechanism to boost development. However, with both expanding their business, such regional differentiation no longer exists, and worse, the two companies have entered into price wars and other cutthroat competitive practices on overseas markets, which weakens China's international competitiveness in rail transport equipment manufacturing.

Yang Xiaolei, an analyst with HuaAn Fund Management Co, says the merger will facilitate integration of China's high-speed train resources, reduce internal price wars and enhance technological research and development, in a bid to sharpen China's international competitive edge in this field and better tap overseas markets.

Chen Jianing, a researcher with Everbright Securities Co, expects the merger to result in better cost controls, sharing of resources and R&D, and avoidance of overlapping investments, thus improving the new company's long-term profitability.

Propelled by China's increasing investment in railways and rising demand from abroad, the new company is likely to see fast profit growth in the future.