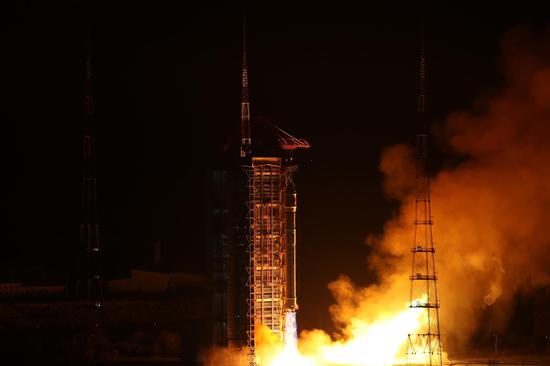

An employee works at the site of a photovoltaic power project in Lianyungang, Jiangsu province, on Dec 14. GENG YUHE/FOR CHINA DAILY

"On the supply side, as financial barriers increase and technological bottlenecks emerge, the sector is entering a period of intense competition, with companies likely to face greater competition and potential market exit," Tan said. "While the rapidly changing global trade environment presents significant challenges for the industry as it navigates these shifting dynamics, leading solar companies with continuous technological investment and business model renovation are expected to rise through it."

While Chinese solar companies are readjusting and accelerating their global capacity expansion beyond Southeast Asia in response to new trade barriers and local manufacturing incentives, the US remains one of the most profitable and promising markets, with relatively low risk for manufacturing plants being set up locally, especially with the push for renewable energy manufacturing to return, he said.

"With the upcoming shift toward greater localized production, the industry is expected to face fewer additional risks in the US market," said Tan. "The upcoming launch of overseas polysilicon manufacturing in the Middle East also offers significant cost advantages, providing a solid foundation for establishing a localized photovoltaic supply chain in the region."

Tan added that Europe's solar market is slowing due to lower power prices and market saturation, but there is still strong growth in other markets including the US, China and Saudi Arabia.

Despite the technological advances leading to price declines for key components such as solar panels and batteries, it is also putting pressure on manufacturers, with many facing squeezed margins. The increased competition in the global market has only compounded these difficulties.

In turn, industry experts call for Chinese manufacturers to work together to maintain their competitive edge, amid a backdrop of the declining prices for key components, which in turn lead to increased competition and squeezed margins.

Gu Yu, deputy director-general of the trade remedy and investigation bureau of China's Ministry of Commerce, said photovoltaic companies should strengthen capacity adjustment by quickly focusing on optimizing existing capacity, controlling expansion and improving quality.

The photovoltaic industry has continued to make steady progress in 2024, contributing to the acceleration of China's green and low-carbon transformation and the development of a green, low-carbon and circular economy, he said.

Thanks to the collective efforts of the entire industry, by the end of September, China's total wind and solar power installations reached 1.25 billion kW, achieving the 2030 target for total wind and solar power capacity six years ahead of schedule, he added.

New products such as electric vehicles, lithium batteries and photovoltaic cells are increasingly becoming powerful drivers of China's development of new quality productive forces. While these products have shown strong export performance, they are also facing the pressure of foreign trade and investment restrictions, said Gu.

Even with these headwinds, industry leaders are optimistic about the long-term prospects of solar energy.

Cao Renxian, chairman of new energy power equipment maker Sungrow Power Supply and president of the CPIA, emphasized the need for innovation and continued investment in research and development to overcome current challenges and ensure sustained growth in the renewable energy sector.

It's essential to focus on diversified overseas layout, avoid concentrating efforts in the same overseas markets and carefully navigate the direction of expansion abroad, Cao said.

With clear advantages in Chinese solar products and technologies, we must proactively address international trade challenges and work together to navigate trade frictions, he added.

Strengthening international communication and cooperation is essential to promote the open, fair and orderly development of the global photovoltaic market, he said.

Global consultancy Rystad Energy expects 255 GW new solar PV installation from China in 2024, which is at the same level as the forecast after adjustment. Another surge in installation toward the end of the year is also expected, of around 20 GW from November and 50 GW from December, it said.

"Solar PV installations have maintained a quite high pace this year, and we had seen an average of over 18 GW of monthly installations this year in China till October," said Zhu Yicong, vice-president of renewables and power research at global consultancy Rystad Energy. "Renewable installations have surged since last year and the momentum has not been slowing down. China has shown its clear leadership in global solar PV installations and we are expecting close to 60 percent of global solar PV installations from China this year."

京公網安備 11010202009201號

京公網安備 11010202009201號