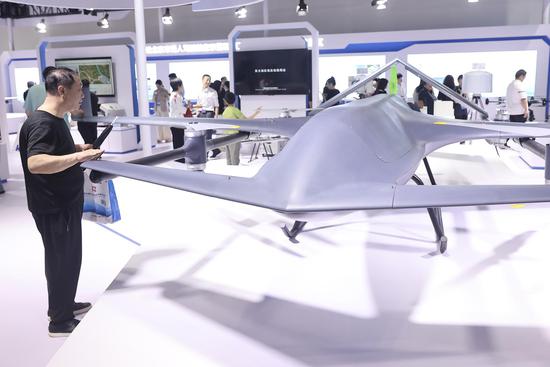

As the new quality productive forces will serve as a major economic driver for China during its ongoing efforts to deepen economic transformation, more policies supporting technology companies, especially the small and medium-sized ones, can be expected after the third plenary session of the 20th Central Committee of the Communist Party of China, said experts.

They made the prediction after smaller-cap technology companies showed strong growth as of Tuesday. While the benchmark Shanghai Composite Index rose a tad on Tuesday, ChiNext in Shenzhen, where technology-focused companies are traded, climbed 1.39 percent.

ChiNext-listed machinery equipment maker Nanjing Railway New Technology and electronic equipment company Sunwoda Electronic saw their respective share prices surge to the daily limit of 20 percent on both Monday and Tuesday. Solar energy equipment provider Suzhou Maxwell Technologies and lithium battery company EVE Energy, two well-known ChiNext companies, saw their prices rise 5.44 percent and 3 percent, respectively, on Tuesday.

The Beijing Stock Exchange, home to shares of many technologically advanced small and medium-sized companies, also saw robust trading on Tuesday. Only four out of the 249 BSE-listed companies reported a loss on Tuesday, lifting the BSE 50 Index by 2.68 percent.

Xiu Qiang, joint chief strategist of CITIC Securities, explained that the A-share technology sector has seen a business turnaround since mid-2023. Electronic companies' profitability has been especially noticeable over the past two quarters.

The bullish performance of these technology companies will be further consolidated by clearer plans for the development of new quality productive forces after the ongoing third plenum, he said. More supportive policies may be introduced for the low-altitude economy, the digital economy and biomedicine after the meeting, he said.

Ying Ying, chief computer industry analyst at China Securities, anticipates more support to technology-advanced SMEs, given that a number of stimulative measures to further facilitate technological innovation have been introduced over the past few months.

The third phase of the China Integrated Circuit Industry Investment Fund was launched on May 24, with a registered capital of 344 billion yuan ($47 billion), outnumbering the size of the previous two phases. A 500 billion yuan reloan to serve technology innovation and transformation was set up in mid-June, among which 100 billion yuan will be used to support tech startups and SMEs.

The State Council, China's Cabinet, released a set of measures on June 15 to facilitate the high-quality development of venture capital firms. Four days later, the China Securities Regulatory Commission, the country's top securities watchdog, issued eight new measures to deepen the reform at the STAR Market of the Shanghai bourse.

"The capital market will attach greater importance to A-share technology companies amid central regulators' emphasis and accelerated planning for technological innovation," said Ying.

The capital market has already taken action in this direction. The exchange-traded fund tracking the largest 100 ChiNext companies in terms of market capitalization, launched by China Asset Management in 2017, received net capital inflows of over 12.9 million yuan over the past 10 days, according to market tracker Wind Info.

A quick review of the market performance during the previous third plenum meetings since 2000 showed that rebound of growth-oriented enterprises had a probability of about 75 percent, said Li Meicen, chief strategist at Caitong Securities.

Small-cap tech companies with higher price elasticity, including those specializing in TMT (technology, media and telecommunications), power equipment and new energy, usually show stronger growth in the two months after the third plenum. Based on the top regulators' previously launched fundamental research plans, companies focusing on quantum information, synthetic biology and the low-altitude economy may gain more support after the third session, he said.

The average valuation of A-share tech companies is much lower than their peers in overseas markets, said experts from Everbright Securities on Tuesday. In anticipation of more policies to boost technology innovation, these companies' valuations will likely be adjusted significantly in the medium term, they said.

shijing@chinadaily.com.cn

京公網安備 11010202009201號

京公網安備 11010202009201號