According to Zhou from JLL, some banks have extended approval period for loan applications from a minimum of one week before to at least one to two months last year. She expected the loan application process to become more smooth with more policy clarity expected to emerge this year compared to a year ago.

A net 400 billion yuan ($63.32 billion) was released in late April from the central bank's reserve of commercial banks' deposits, with another freeing of 900 billion yuan set to erase lenders' liability to the central bank through the Medium-term Lending Facility or MLF.

This monetary policy operation, or a reduction of the reserve requirement ratio or RRR by 1 percentage point but in an innovative way, is expected to supplement liquidity especially for small and medium-sized banks without making overall monetary policy too loose, according to experts.

"The reduction in RRR was to offset the impact of the tightening of interbank lending making sure small banks have enough liquidity. This is in keeping with the general financial de-risking that is taking place and will unlikely have a significant impact on the property market," said Macdonald.

Zhou agreed with the projection, adding that the loan environment will be tightened further nationwide this year compared to a year ago, and it will further affect total transaction volume of the home market.

Regarding the ongoing trade friction between China and the United States, Macdonald said the property market is unlikely to see any significant direct impact. But he also said, "It could impact business revenues and profitability. Therefore, it may encourage companies that might be affected to take action".

According to Macdonald, possible results include holding off on large investments, such as relocation offices and the associated fit-out costs, taking on additional operational costs such as new headcount (meaning less office expansion requirements), reducing costs by potentially looking at decentralized locations if they need to relocate, as well as seeking more flexible accommodation options such as co-working or serviced offices.

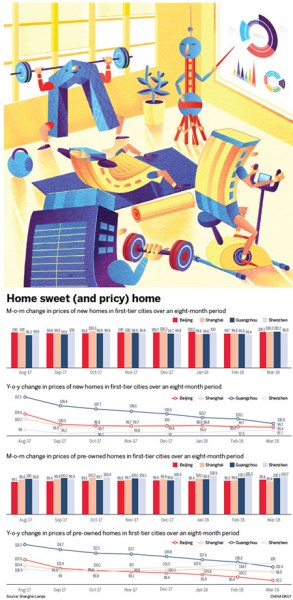

"If you look at the first-tier cities as a whole, monthly price changes were positive (that is, there was growth) in both first- and second-hand markets, and individual cities might have recorded minor declines."

All in all, the residential property sector in Chinese big cities will remain resilient as China's economy as a whole will continue to be positive, said experts.

Since third- and fourth-tier cities are taking the heat of home price growth, the SUFE report projected that home prices in first-tier cities will likely stabilize throughout 2018.