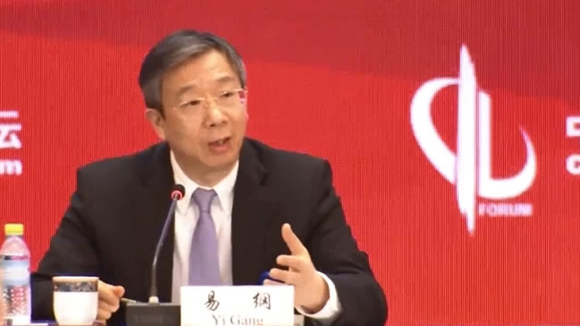

China's new central bank governor Yi Gang. (Photo/CGTN)

Yi Gang, China's new central bank governor, said on Sunday that China will push forward reform and opening up of the financial industry while preventing financial risks through regulation and supervision.

In a debut speech as the new chief of People's Bank of China (PBOC), Yi summarized the current financial policies into prudent monetary policy, promotion of reform and opening up in financial industry and maintaining stability with diffusing any major risks.

China's practices since it conducted reform and opening up policies have approved that "opening up leads to progress while closure results in backwardness and risks," he said at the China Development Forum in Beijing.

Three rules in financial opening up

There are three rules to follow in promoting financial opening up and reform, Yi said.

First of all, China will keep lifting the restriction of financial industry access and giving equal treatment to all investors, in line with the negative list mechanism principle, he said.

In addition to the stocks and bond connect projects between A-share market and Hong Kong as well as A-share included into MSCI, China will further open its foreign exchange market and fully implement the negative list mechanism in terms of market access, according to Yi.

The sector's opening up will proceed in coordination with foreign exchange rate mechanism reform and capital account convertibility, he said.

China will steadily internationalize Chinese yuan, he said, noting China will improve free usage of Chinese yuan with opening more capital projects.

The second phase of the China International Payments System (CIPS), a cross-border yuan settlement system, will be rolled out soon, he said.

The third rule is putting "equal emphasis" on preventing financial risks, he said, noting that the opening up of the financial sector must be accompanied by the development of financial regulation.

Confidence in front of changes and risks

To keep stability of financial industry and guard against risks is a major task for China's financial sector, but China has the capability to prevent risks, especially the high leverage, Yi said.

Responding to what additional financial risks may be caused by new uncertainties, such as the trade tension between China and the US, Yi said that fluctuation is not rare in market economy and China's banking system, securities market and insurance market are fully capable of dissolving risks from external impacts.