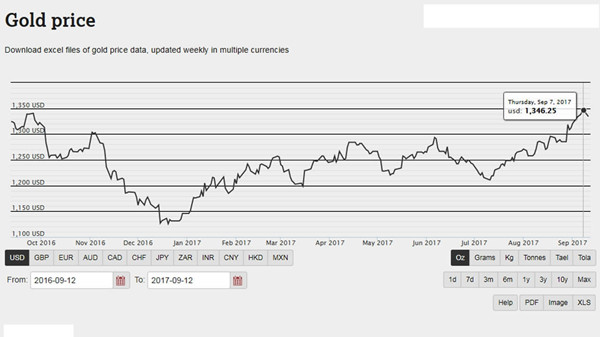

Gold price from September 12, 2016 to September 12, 2017 (World Gold Council Photo)

China is the world's largest gold importer, producer, processor, as well as consuming nation. In 2016, the country produced 453.49 tons of gold, ranking the first for 10 years consecutively. China's gold consumption reached 975.38 tons in 2016, the first on the list for four continuous years.

However, China's voices and performances in the global gold market are imbalanced. World Gold Council, the most important global gold organization has 22 member companies, with only one belonging to China – China National Gold Group.

"We're the only member on the World Gold Council (WGC) and we help to give more attention to our market. We introduced yuan-denominated gold products. If we keep at it, this would lift our voice," Song Xin, chairman of the China National Gold Group, said.

While the vision is lofty, Song stressed "prudent is best" for Chinese gold enterprises – having "a clear strategy and talent reserves" before taking the first step.

"China Gold is 'going out'. We've also introduced international talent to be technical support. They understand global rules and reserves calculation. We need a clear strategy and talent reserves to go out, to ask whether the project is reliable, what are the problems with the investment environment," Song noted.

According to WGC's data, global production of gold in the first half of 2017 has dropped 10 percent year-on-year to 2,098 tons, and demand in the same period has declined 14 percent year-on-year to 2,002 tons.

While some are concerned that the gold market might not be so hot as before, Song insisted on his positive forecast, elaborating that "the supporting factors for gold prices traditionally are geopolitical tensions, oil and CPI. Our mid-long term forecast is positive. Because judging by CPI factors, gold price isn't even at 1980s levels."

Rising tensions on the Korean Peninsula, which bolstered demand on gold as one of the safe-haven assets, also proved his optimistic prediction. The price of gold even touched 1,346.25 U.S. dollars an ounce on September 7, the highest since last September.

Besides, Song is confident that gold can still be a safe haven asset in the future, and could help with yuan's globalization.

"I personally think that's possible. International central banks place a lot of emphasis on reserves. The U.S. still has 8,133 tons of gold. They didn't touch it even during the global financial crisis. The council members of the UN also have lots of reserves. From the perspective of yuan globalization, you need lots of gold reserves," Song explained.