Government still supports legal outbound investment

China's cross-border capital flows were stable and balanced in the first half of this year, "the best phase in nearly three years," while individuals developed an increased awareness of how to use foreign currency legally, the State Administration of Foreign Exchange (SAFE) announced at a press conference on Thursday.

Domestic individuals' desire to hold foreign currency has been decreasing in general. In the first half of 2017, individual purchases of foreign currency slumped by 4 percent year-on-year, compared with 14 percent growth in the same period last year, Wang Chunying, a spokesperson of the SAFE, said at the conference. Wang didn't disclose the exact amount of foreign currency purchased by individuals during the period.

Domestic residents' foreign currency holdings fell $1.7 billion year-on-year in the first six months this year, Wang said.

Liu Xuezhi, a senior analyst at Bank of Communications, said that the figures showed the efforts of the government's intensified management of the current account in recent months.

The current account includes the balance of trade and net transfer payments like those involving tourism.

"Some people transferred money abroad to engage in overseas investment (in earlier periods), which increased the pressure of capital outflows. But this phenomenon eased a lot after the government launched a guideline in early 2017 that banned individuals from acquiring foreign currency to buy properties or invest in securities on offshore markets, " Liu told the Global Times on Thursday.

In the first six months of 2017, domestic banks sold foreign exchange worth 5.95 trillion yuan ($879 billion) and bought 5.31 trillion yuan worth of foreign currency.

Chinese banks' net foreign exchange settlement deficit reached $93.8 billion, down 46 percent on a yearly basis, according to data revealed by Wang from the SAFE.

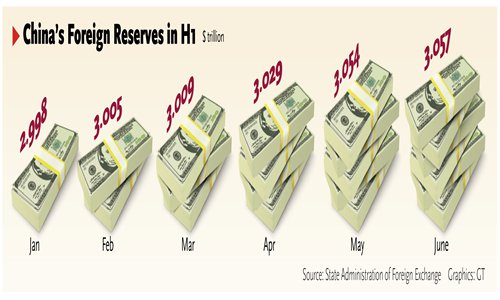

The supply-demand balance in the foreign currency market helped China's foreign currency reserves to continue rising. As of the end of June, reserves reached $3.06 trillion, up $46.3 billion compared with the end of 2016. It was the fifth consecutive monthly gain in the reserves.

Wang said that capital outflows via non-banking institutions decreased a lot, which means that China has continued to emerge from the "shadows" involving capital outflows that hovered over the nation around 2016.

Zhou Yu, director of the Research Center of International Finance at the Shanghai Academy of Social Sciences, said that apart from government management, other factors like the weakening dollar and the improving domestic economy have also helped stabilize the foreign currency market.

The US Dollar Index had dropped from 102 at the end of 2016 to 95 as of 5:56 pm Beijing time on Thursday.

China's GDP grew 6.9 percent in the first half of 2017, compared with 6.8 percent growth in the fourth quarter of 2016.

"But I don't think that we can completely let our guard down about future capital outflows, because the dollar might strengthen again and the impact of the slumping real estate sector on the domestic economy might become evident later this year," Zhou told the Global Times on Thursday.

Liu said that "instability factors" in China's foreign currency market, such as domestic economic instability or external pressure from a stronger dollar, are decreasing and the foreign currency situation will improve further.

Wang noted that the SAFE's policy involving currency movements has been consistent, and it will insist upon supporting legal outbound direct investment and promoting the convenience of overseas trade and investment while being alert to possible investment risks.

According to Liu, the government should consider easing its grip on foreign currency management, since the pressure of capital outflows has eased.

He also said that measures should be taken toward reforms involving the capital account such as speeding up the bond connect program.