A telecommunications engineer on the verge of retirement, Chen wanted to live in Hainan with his wife and their 27-year-old daughter, who works and lives in Haikou, the provincial capital.

In 2015, Chen had bought on mortgage an apartment for his daughter in Haikou. He wanted to follow it up with another home for his post-retirement life.

"After retirement, it'd be good for us to live near our daughter, separately. But under the new rules, we need to drop this plan. Or, we have to first sell our property in Shanghai and pay the full asking price in Hainan, something my wife is reluctant to do," Chen said.

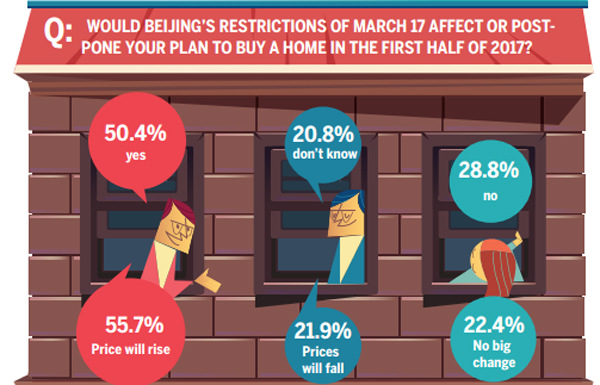

Hainan is among the latest provinces that are curbing speculative investors and runaway property prices. The crackdown started in March 2016 when Beijing and Shanghai imposed restrictions on home purchases.

According to Centaline Property, 45 cities across China have introduced more than 140 new rules on home purchase restrictions in the last 12 months.

According to Albert Lau, CEO of Savills China, a property consultancy, more restrictions on speculation may be introduced this year. And more cities, including lower-tier ones with prestigious locations neighboring key cities, are likely to introduce limits on both purchases and home finance.

Homebuyers keen on better or larger accommodation are bearing the brunt of these measures. Owners of homes with an eye on more spacious units or houses in desirable or convenient locations have realized such dwellings are now defined as "second home" in many cities.

That means higher down payments, sometimes up to 70 percent of the property price, in several cities, said Lau.

"Higher down payment requirement is one of the most powerful tools to tackle an errant or distorted market. It's more powerful than limits on homebuyers' qualifications. Residential properties are expensive commodities, and many buyers need home finance. If limits on financing are tightened, many buyers would be pushed out of the market," he said.

Consequent to the latest curbs, lower-tier cities located near top-tier cities and easily accessible through railways or highways, are likely to see a rise in demand for homes. For, homebuyers from main cities are expected to divert their investments to lower-tier cites.