Foreign investment in bonds

Further opening up to promote yuan internationalization: experts

China has stepped up efforts to open up the domestic bond market, but so far overseas investors are still adopting a cautious attitude toward investing in domestic bonds, due to concerns such as inconvenience and the fluctuating yuan, experts told the Global Times on Tuesday.

On Tuesday, Chinese Premier Li Keqiang said that a bond connect mechanism between the Chinese mainland and Hong Kong will be launched this year, stcn.com reported.

China's bond market, the third largest in the world, was closed to most international investors until February 2016, when the government announced that a wide range of foreign institutional investors would be given quota-free access to the Chinese Interbank Bond Market (CIBM).

Ivan Chung, associate managing director at Moody's, told the Global Times on Tuesday that the government opened the bond market to overseas investors mainly to promote the yuan's internationalization.

"The Chinese market encourages overseas investors to hold the yuan as an investment and financing tool, but the Chinese onshore financial market is not much connected to exterior markets and there are too few offshore yuan-denominated assets. If the bond market isn't opened, what yuan denominated assets can overseas investors invest in?" he noted.

Xi Junyang, a finance professor at the Shanghai University of Finance and Economics, said that the opening of the domestic bond market is a "breakthrough point" for China's financial opening-up, as bond investment is relatively safer, with longer investment cycles and stable yields, compared with other investment means like stocks, he told the Global Times on Tuesday.

Investor observation

The Chinese government's moves to open up the bond market have generated some positive effects. According to a survey from Deutsche Bank, over half of the respondents said the quota-free system for CIBM market access had moved forward their institutions' timeline for increasing investment in the market, the South China Morning Post reported in October 2016. Respondents to the survey were primarily Asia-based senior staff at global asset management firms.

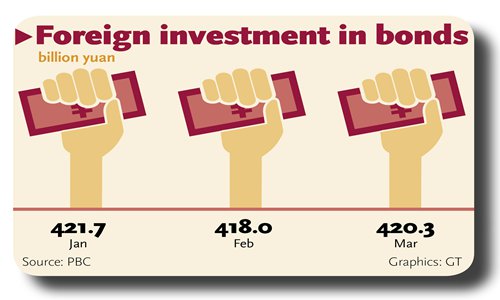

However, most overseas investors still hold a wait-and-see attitude on investing in the domestic bond market. Overseas institutions held about 420 billion yuan ($60.9 billion) worth of bonds by the end of March, up 2.3 billion yuan on a monthly basis after a two-month decline, ifeng.com reported in April.

According to a straitstimes.com report in March, overseas holdings dropped to just 1.3 percent of the $9 trillion Chinese bond market by the end of 2016, down from 1.4 percent in February 2016.

According to Chung, most of the 3,000-plus bond issuers in China are unfamiliar to overseas investors. In addition, the yuan is still relatively weak compared with the dollar, which has influenced the decisions of overseas investors.

"Also, it's not very easy for overseas investors to execute trading in the onshore market without the help of a good platform, as bond trading is complicated and not that transparent compared with stock trading. That's why the bond connect mechanism is important as it would help facilitate overseas trading in the domestic bond market," Chung noted.

Xi noted that use of the yuan is still not frequent enough, and that the cost of currency exchange might have prevented overseas investors from investing in domestic bonds, which are all yuan denominated.

"Overseas investors are still in a phase of observation and they need a few years to get familiar with the domestic bond market," Chung noted.

J.P. Morgan China economist Zhu Haibin said that the domestic bond market will become an important part of the global market as it opens up. "It's a trend that overseas investors will gradually increase their holdings of domestic bonds," he told the Global Times Tuesday.

Chung noted that the attitude of overseas investors wouldn't impact the domestic bond market too much, as it is not reliant upon overseas investors.

In 2016, China issued 36.1 trillion yuan in bonds, up 54.2 percent year-on-year, data from the PBC showed in January.

According to professor Xi, banks are increasingly cautious about lending, and so many people have turned to the bond market.

"Besides, although bond trading also has default risks, the risks are not a spreading type like what may be caused by banks' failure to pay money back to the depositors," he noted.