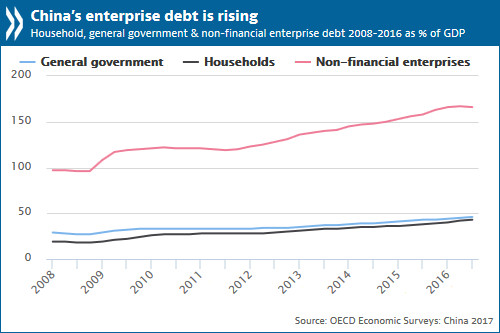

A chart illustrates that China's enterprise debt is rising. (Photo provided to chinadaily.com.cn)

Over-leveraging and over-capacity are two major challenges for China's economy in the "new normal" with slower but sustainable growth rates, a new biennial report from the Organization for Economic Co-operation and Development (OECD) pointed out.

The report called "Economic Surveys China" publishes every two years in order to give assessment and suggestions towards Chinese economy, the analyze and output of this survey has been discussed and reviewed by Economic and Development Review Committee, with participation of representatives from Chinese government.

"The Chinese economy growth remains high by international standards, and is gradually moderating as the population ages and the economy re-balances from investment to consumption, from external to internal demand and from manufacturing to services," OECD director of country studies Alvaro Pereira told China Daily website.

Pereira stressed the State-owned enterprises reform would be a vital move among government's agenda of de-leveraging. According to National Bureau of Statistics' data, debt owed by non-financial firms in China reached 170 percent of GDP in 2016 - the highest level among leading economies. SOE's debt makes up over 70 percent of total corporate debt.

"One thing I like about China is that government always pays attention to the signals, including potential risks and problems, and is always careful, in terms of designing the structural reforms.Signs of financial risks has been noticed by central government, and measures to tackle with SOE reform has been stressed during this year's two sessions." Pereira said.

As for allowing the companies with too much debt, especially in over-capacity industries, to quit the market, Pereira said firm determination from authorities is crucial.

"Continued progress is important, to allow these process to happen, at least gradually, otherwise they might occupy valuable resources that should be used better in other places," Said the director.

He suggests accelerating the bankruptcy process of zombie firms to reduce uncertainty and compensate laid-off workers under relevant laws.

Pereira also said other barriers to closing down also need to be removed such as subsidies, environmental clean-up costs and social liabilities, particularly in sectors affected by excess capacity.

"The removal of subsidies could partly finance clean-up costs and social liabilities." He added.

There's a qualitative chart within the report to describe several indicators assessing 64 countries originally included in the Belt and Road Initiative (which has been broaden to over 100 countries now), like outward investment and logistics performance of infrastructure, which measures the logistics professionals' perception of a country's quality of trade and transport-related infrastructure. This chart illustrates concrete pictures around the trade infrastructure situation of countries involved in Belt and Road.

When asked how this initiative would benefit Europe's economic recovery, Pereira responded:

"We think this initiative has so much importance for several reasons, one of them is that this initiative would make strong links with many countries. Belt and Road is crucial and definitely would bring more comprehensive infrastructure linkages, create more jobs and help many European economies better develop."

A serious problem pointed out in the report is that China's tax and transfer system has not been functioning as well as other leading economies on reducing income inequality. For example, many low-income households pay a higher share of income in social security payments than richer ones. And workers who are outside the formal labor market are not required to participate in the pension and medical insurance schemes in China, potentially increasing their financial vulnerability to future shocks.

The report recommended that the reform should base the calculation of social security contributions of low-income workers on actual income earned, instead of the current system that makes a minimum contribution based on the previous year's local average wage.

It argues this change could be partly financed by reforms to personal income tax such as removing exemptions that favor high-income individuals. For example, interest receipts from government bonds or from savings in a deposit account with a Chinese bank are currently excluded from taxable income.