Lower growth in China, regulatory barriers cited in report

Investment from the U.S. in China has been largely flat in recent years, while China's foreign direct investment (FDI) is growing fast in the U.S., data from a report jointly released by Rhodium Group and the National Committee on U.S.-China Relations showed on Thursday.

According to the report, U.S. FDI in China amounted to about $13 billion in 2015, down from about $16 billion in 2012 and about $21 billion in 2008.

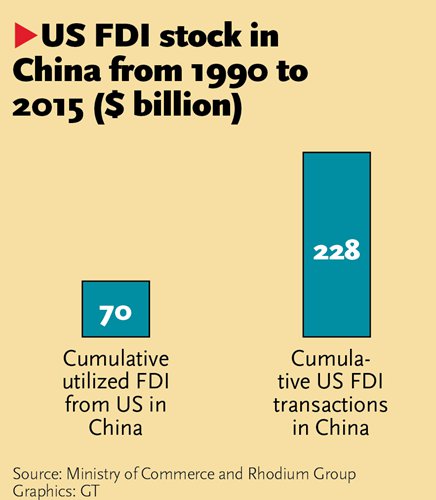

The report also showed that the total U.S. FDI in China from 1990 to 2015 stood at $228 billion.

Daniel Rosen, founding partner of Rhodium Group, said that the general trend of U.S. investment in China reflects several factors. First, the outlook for China's economic growth is quite weak now compared with the past, so U.S. companies are no longer increasing their investment in China as much as they did in the past.

He also said the Chinese government has not entirely opened its doors to overseas investment, restricting the scale of FDI from the U.S.

"We are waiting for the Chinese government to complete its liberalization of foreign investment rules to allow American healthcare companies, high-tech companies as well as financial firms to expand their presence here the way they want to," Rosen told the Global Times on Thursday.

"If both those things change - that is, if China's economic outlook goes up, and if walls come down, we will see a significant increase in U.S. investment in China," Rosen said.

Sang Baichuan, director of the Institute of International Business at the University of International Business and Economics in Beijing, said that the major reason for slumping U.S. FDI in China is the falling investment ability of U.S. companies since the global financial crisis in 2008. He said the U.S. is cutting overseas investment not only in China, but also in other countries and regions.

In contrast, Chinese companies only started to invest in the U.S. in about 2005, but investment surged quickly and rose to about $15 billion in 2015.

The statistics show that the U.S. is "open and welcoming to Chinese investment," the report said.

The figures in the report were calculated based on individual transactions, and they may not be fully accurate because of tax-optimization strategies used by investors and delays in making actual investments.

Sang said that in recent years the U.S. government has adopted a strategy to boost the manufacturing industry. Also, the U.S. has advantages in areas like research and development, technology and talent. That's why many Chinese investors have been attracted to the U.S.

He also told the Global Times on Thursday that in recent years, the Chinese government has been pushing domestic enterprises to invest abroad. The rising market expectations for a slumping yuan have also caused domestic investors to put more money into the U.S.

As to Sino-U.S. bilateral investment, experts also hold optimistic views. Steve Orlins, president of the National Committee on U.S.-China Relations, said on Thursday that he expects U.S. President-elect Donald Trump will follow policies that will increase overseas investment in the U.S.

According to Orlins, the source of the capital, whether it's from China or from other countries and regions, does not matter. What matters is the importance of creating more jobs in the U.S..

"Trump is a business person. He has been a job creator throughout his life ... As a businessman, he will understand and he does understand that foreign investment creates jobs in the U.S.," Orlins noted.

Sang also noted that after the U.S. presidential election, the unpredictability of U.S. policy has strengthened people's worries about overseas investment. If the incoming U.S. government adopts a de-globalization strategy, that will hurt its investment relations with China.

"Such a strategy will not only hurt the global economy but the U.S. economy as well. So I don't think that will become a trend in the future," Sang noted.

Orlins also stressed that "the trade area might be different," saying that he's not sure where the Sino-U.S. trade situation will head in the next few years.

China's trade with the U.S. slumped 8.9 percent year-on-year to $419 billion from January to October, data from the General Administration of Customs showed on November 8.