Competitive differentiation key to taking on big players: analysts

A number of domestic and foreign smartphone makers are collaborating with China's major banks and bank card association to roll out their own mobile payment services, a move which experts said is to tap into China's fast-growing online payment market and explore new channels of revenue based on the devices' huge user bases.

However, experts warned that as competition intensifies in the sector, vendors should adopt a strategy of differentiation to secure market share.

Chinese smartphone upstart Xiaomi announced a plan to roll out its own mobile payment service, MI Pay, along with the national bank card association China UnionPay, according to a statement the company sent to the Global Times on Tuesday.

The new service is expected to be officially released on Thursday, the statement said.

The MI Pay platform will support payment from credit and debit cards of more than 10 major banks, the statement noted. It can also replace bus passes and Metro cards in a number of cities including Shenzhen and Shanghai.

The mobile application is based on near field communication (NFC), a technology which enables users to make payments by placing their mobile phone near the sensor of a point of sale machine, according to Xiaomi's Weibo account.

Xiaomi's move trails the increasing number of mobile vendors adopting similar technology and making inroads into the online payment market.

For example, Apple Pay was made available in China in February, and Samsung's mobile payment service Samsung Pay was launched in late March, the Xinhua News Agency reported.

Also in March, Huawei, the world's third largest smartphone maker by shipment, announced its own plan to partner with the Bank of China and offer payment service for its mobile phones and wearable devices, the report said.

Pushed by slow sales

One of the reasons behind these recent moves is slowing sales growth in 2016, mainly due to the end of the demographic dividend in China, Li Chao, an industry analyst at consultancy iResearch Consulting Group, said.

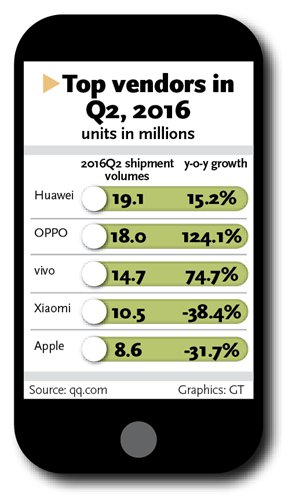

For example, Xiaomi, the biggest seller of mobile phones by shipment in China in 2015, has seen a decline of its phone sales this year, with smartphone shipments dropping 38 percent year-on-year in the second quarter of 2016, Bloomberg reported.

"Those phone makers can no longer bank on smartphone sales revenue to make a profit," Li told the Global Times on Tuesday. "Instead, they are looking to establish their own mobile 'ecosystem' and explore the value in their large user bases to increase the amount of consumption per device."

Some, like Huawei, have already built their own branded e-commerce platforms, in which the digital savvy smartphone user is able to complete online shopping and payment within the "ecosystem," according to Li.

China's rapidly expanding mobile payment market also played a role in the move. In the first quarter of 2016, the market scale totaled 5.97 trillion yuan ($894 billion), up 111 percent year-on year, according to a report published by Analysys, an Internet marketing research company.

"The figures are so stunning that mobile sellers are all flocking to grab a piece of the pie," Wang Yanhui, the secretary-general of Mobile China Alliance, said.

Challenges ahead

However, the road to the market remains bumpy, as the sector is already dominated by leading players, WeChat Wallet and Alipay.

The two companies jointly represent 86.44 percent of the domestic market, leaving newcomers with only a small niche market to explore, the Analysys' report said.

"Despite mobile vendors' huge consumer bases, their users do not see the need to pay through their applications," Wang told the Global Times on Tuesday. "After all, Wechat Wallet and Alipay have monopolized the payment methods in a number of shops."

Experts also pointed out that the two giants, Wechat Wallet and Alipay, are each controlled by a single company, Tencent and Alibaba, respectively, which makes it easier for the companies to focus on promotional campaigns. One the other hand, the online payment services offered by mobile manufacturers are co-developed by smartphone vendors and a number of participating banks.

"When an activity involves the interests of more than one party, it is hard to control the process as well as launch corresponding promotional activities," Wang said.

As such, experts suggest that vendors adopt a strategy of competitive differentiation.

"The use of WeChat and Alipay rely on the Internet, while NFC-based payment can be used where Internet connection is weak," Wang said. "The newcomers can explore new areas under this scenario. The bus pass, which will be part of the program released by Xiaomi, is a good example."