(Graphics/GT)

Move doesn't signal loss of confidence in Chinese firm, experts say

Japan-based SoftBank Group Corp announced on Wednesday it will sell around $7.9 billion worth of shares of Alibaba Group Holding to raise capital and reduce its own leverage.

Experts said the transaction is a normal market decision that will give Alibaba's management an opportunity to strengthen control of the company.

SoftBank will sell $400 million in shares to the Alibaba Partnership, $2 billion in shares to Alibaba itself and another $500 million in shares to an unidentified sovereign wealth fund.

In addition, SoftBank will issue $5 billion worth of mandatory exchangeable trust securities convertible into Alibaba shares in three years. SoftBank has established a new trust with the intention of divesting $5 billion in Alibaba's American Depositary Receipts in a private placement "to qualified institutional buyers," the Japanese company said in a statement Tuesday.

This is the first time for the Japanese telecommunications and Internet giant to lower its stake in Alibaba since 2000, when it first invested in the Chinese company, according to a note Alibaba sent to the Global Times on Wednesday.

As of the end of March, SoftBank held 32 percent of Alibaba, according to the latter's financial report. The shareholding will fall to 28 percent after the transaction but SoftBank will remain Alibaba's biggest shareholder.

SoftBank said in its announcement that it will use the proceeds to cut its leverage and increase liquidity.

"It's a normal market decision for SoftBank to reduce its stake in Alibaba to lower its own debt ratio," Jin Dehuan, chief expert on capital markets at the Shanghai Institute of International Finance Center at the Shanghai University of Finance and Economics, told the Global Times on Wednesday.

SoftBank's debt may be as high as $108.2 billion, according to Bloomberg.

Some analysts said SoftBank's move showed that it has lost confidence in Alibaba, but Jin disagreed, adding that the bank remains the major shareholder.

"If it has lost confidence in Alibaba, SoftBank would definitely cut its holding much more," said Jin.

The deal makes sense, Jin noted. "It is unlikely for SoftBank to see a rapid gain in Alibaba's stock price in the short term," he said. "Alibaba's unsound financial performance and the many questions from the international community due to its longstanding fake merchandise problem have been weighing on its share price, which is unlikely to rebound immediately."

"The reduction is mainly due to SoftBank's own need for funds. There's no need to read too much into it," Xu Zhipeng, vice president at Beijing-based boutique investment bank Spring Partners, told the Global Times on Wednesday.

The shareholding reduction by SoftBank may have a small, transitory influence on investor confidence, Xu said, adding that there is no problem with Alibaba's fundamentals.

Alibaba in May announced that it was the subject of an inquiry from the US Securities and Exchange Commission (SEC) about its accounting practices, and Alibaba said it is cooperating with the probe.

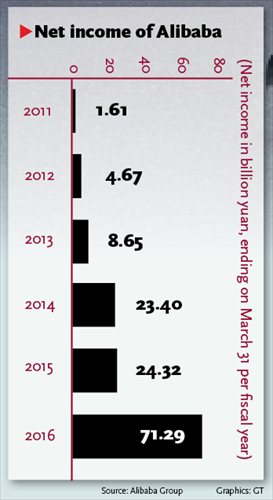

Alibaba also reported lower-than-expected profit growth in the latest fiscal quarter, which ended on March 31, 2016, recording a non-GAAP net profit down 1 percent year-on-year. It had a big quarterly revenue increase, reaching 24.18 billion ($3.68 billion), up 39 percent year-on-year.

Jin said SoftBank's move won't have much impact on the companies' partnership.

SoftBank said in its announcement that the two companies will maintain a "strong relationship," adding that Masayoshi Son, chairman and CEO of SoftBank, will retain his seat on Alibaba's board and Alibaba founder and executive chairman Jack Ma Yun will keep his seat on Softbank's board.

"This reduction will certainly help Alibaba's management strengthen its control over the company," Jin said, adding that Alibaba's management has long had that advantage because "SoftBank has given Alibaba great autonomy."