(Graphics: GT)

Strongest overall business activity expansion in 11 months

Chinese economists remained cautiously optimistic following a private survey Wednesday which showed a rebound in overall business activity in March, the strongest expansion in 11 months.

The Caixin China general services purchasing managers' index (PMI), based on a survey by financial information service provider Markit and sponsored by Caixin Media, came in at 52.2 in March, up from 51.2 in February.

The manufacturing PMI for March was 49.7 points, up from 48 in February.

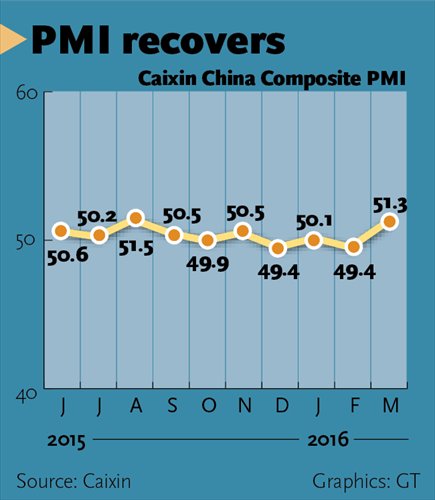

The Caixin China Composite PMI, which covers both the services and manufacturing sectors, was 51.3, higher than February's 49.4 - the strongest expansion of overall business activity in 11 months, according to a report released by Caixin on Wednesday.

A reading above 50 indicates expansion, while a reading below 50 represents contraction.

However, the survey's employment sub-component in the services sector slid to below the neutral 50-point level, the first contraction since August 2013.

The figures, together with official PMI data published by the National Bureau of Statistics (NBS) on Friday, was seen by some analysts as a sign of a warming Chinese economy.

Experts said this means the government's fiscal and credit policy support are beginning to have an effect.

The official PMI for the manufacturing sector registered 50.2 in March, up from February's 49, its highest level since August, according to data released by the NBS on Friday.

The index for non-manufacturing business activity stood at 53.8, up from 52.7 in February, reversing a downward trend since December.

Cautiously optimistic

The March rebound could be attributed to the government's fiscal policies and plans, such as a debt-to-equity swap program, said Zhang Ning, a research fellow with the National Academy of Economic Strategy at the Chinese Academy of Social Sciences.

"However, single month data is not enough, and it needs at least quarterly data to see if a recovery is in the making," Zhang told the Global Times Wednesday.

"Overall, the services sector performed well, but the economy is riding choppy waves, indicating the lack of a solid foundation for a recovery," He Fan, chief economist at Caixin, said in a press release Wednesday.

"The government needs to continue to pursue 'supply-side reforms' to encourage the development of emerging industries," He said.

Liu Dongliang, a senior analyst at China Merchants Bank, said the PMI figures should be seen with cautious optimism.

It remains to be seen whether the current rebound will continue, given that the surge in credit in January will not be sustainable, Liu told the Global Times on Wednesday.

In February, Chinese banks extended 726.6 billion yuan ($112 billion)in new yuan loans, pulling back from a lending splurge in January with a record 2.51 trillion yuan, according to data from the People's Bank of China, the country's central bank.

Warming signs

The data also comes as two of the "Big Three" credit rating agencies cut China's outlook.

US credit rating agency Standard & Poor's (S&P) downgraded China's outlook from "stable" to "negative" on March 31 in light of potential economic and financial risks amid the economic restructuring.

In early March, Moody's downgraded China's outlook to "negative" from "stable."

Vice Finance Minister Shi Yaobin said S&P and Moody's have overestimated the difficulties China is facing while underestimating its ability to pursue reforms and cope with risks, according to a report by the Xinhua News Agency on Friday.

It is economic fundamentals and not the ratings that will have an impact on the economy and financial markets, said Shi.

Fitch, a third rating agency, reaffirmed China's sovereign A+ rating, believing that China has the administrative and financial resources to avoid a disruptive slowdown to near-zero growth over the rating horizon of about two years.

However, high and rising leverage in the economy is a mounting source of systemic vulnerability, according to a report Fitch sent to the Global Times on Wednesday.

"PMI figures reflect a temporary rebound in economic activity, but it remains to be seen if this could lead to a solid trend, whereas the rating agencies are more focused on the long-term perspective," Liu said.

Zhang said the move by rating agencies reflects the long-term economic challenges China faces.

China is due to release its first-quarter GDP data on April 15.