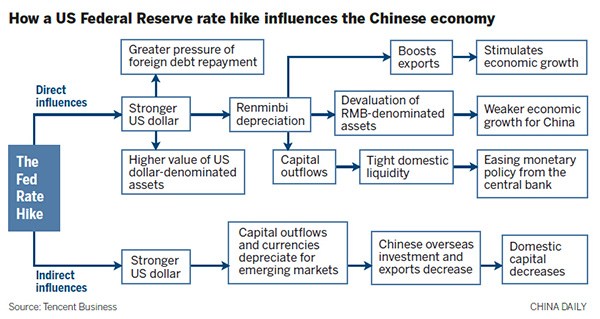

Chinese currency may decline further, while monetary policy is also likely to be affected

China's monetary policy and the renminbi's value face major uncertainties in the capital market after the U.S. Federal Reserve's first interest rate rise in 10 years, according to economists.

This is especially the case as few indicators point to a reversal in the country's economic slowdown, they said.

The Fed decision, announced by chairwoman Janet Yellen on Wednesday, saw it raise rates to 25-50 basis points from 0-25.

Emerging economies, especially China, will be most affected by the rate rise, according to research by Goldman Sachs.

The renminbi may fall further against the U.S. dollar, devaluing renminbi-denominated assets and triggering increased capital outflows, economists said.

The yuan fell against the dollar for the ninth consecutive day on Thursday, with the daily reference exchange rate being adjU.S.ted to 6.4757 per dollar from 6.4626 a day earlier.

The renminbi has dropped by 1.4 percent against the dollar in two weeks.

According to the State Administration of Foreign Exchange, China's top foreign exchange regulator, Chinese banks bought foreign exchange worth $116.7 billion last month and sold $171.5 billion, expanding the deficit to $54.8 billion from $20.1 billion in October, indicating accelerated capital outflows.

An official from the foreign exchange watchdog said last week that measures may be taken to curb abnormal cross-border capital flows if necessary.

The People's Bank of China, the central bank, did not comment on the possibility of a monetary policy adjU.S.tment after the Fed's rate rise.

Andrew Colquhoun, head of Asia-Pacific Sovereigns at Fitch Ratings, said, "The onset of sU.S.tained capital outflows since 2014 has added to ... concerns over the consequences of the rapid rise in debt across the economy."

As Chinese economic growth may continue to slow next year-to between 6.6 and 6.8 percent as predicted by government think tank the Chinese Academy of Social Sciences-enterprises and local governments may feel greater pressure on debt repayment.

The academy has forecast that the economy will grow by 6.9 percent this year.

Zhu Haibin, chief China economist at JP Morgan Chase & Co, said a further interest rate cut would reduce financing costs for enterprises and local governments, but the scope for this is very limited.

The central bank has cut interest rates five times in 12 months. The one-year deposit rate now stands at 1.5 percent and lending rate at 4.35 percent.

Zhu predicted that the central bank may lower the reserve requirement ratio, or the amount of cash that financial institutions mU.S.t set aside, "as early as this month, to complement liquidity when capital outflows accelerate".

Gao Zhanjun, managing director at CITIC Securities, said authorities may shift to an "easy" monetary policy from a "prudent" one next year, and this should strike a balance between ongoing restructuring reforms and policy support for growth.

"That would be a more difficult task as the global financial environment changes," he said.