Tsingtao to buy Suntory's stake in JVs

Tsingtao Brewery Co, a renowned major beer brewer in the Chinese mainland, said Monday it will buy the stake held by Japan's Suntory Holdings in their joint ventures, a move intended to boost efficiency, analysts said.

Experts said brewers that want to survive in the vast, competitive Chinese beer market must increase their economies of scale and rationalize their structures.

Tsingtao will acquire Suntory's 50 percent stake in the joint venture, formed in 2012, for 822.9 million yuan ($129.5 million), the Qingdao-based brewer said Monday in a statement to the Hong Kong Stock Exchange.

Tsingtao will then be in full control of two joint ventures Suntory Tsingtao Brewery (Shanghai) Co and Tsingtao Brewery Suntory (Shanghai) Sales Co, while maintaining the rights to use Suntory's trademarks based on the license terms the companies agreed on, Tsingtao said in the statement.

The move will integrate Tsingtao's operations, create synergies and improve overall efficiency, the company said.

The announcement came days after media reports surfaced that Suntory might unwind the joint venture because of losses. The joint venture generates about 40 billion yuan ($336 million) in annual sales but has failed to bring in profits, the Financial Times reported on Friday.

Experts said the merger will increase Tsingtao's scale and help it compete in the Chinese market.

Brewers that operate on a large scale and offer well-known brands tend to expand in the Chinese market, and that is what Tsingtao is after in this case, Wang Danqing, a partner at Beijing-based ACME consultancy, told the Global Times on Monday.

Wang noted that such moves have become an international trend for the industry.

Just last week, global brewer giant Anhesuer-Busch InBev struck an agreement in principle to acquire its closest rival, SABMiller, for about $104 billion, The New York Times reported on Tuesday. Both companies have business ventures with local brewers in China.

Wang said the change in the Chinese joint venture also reflected difficulties foreign brewers such as Suntory face in gaining mainland market share as they face an entrenched industry structure dominated by major players like Tsingtao, China Resource Enterprise (known as CR Snow) and Beijing Yanjing Brewery Co.

CR Snow controlled 23.2 percent of the mainland beer market in 2014, followed by Tsingtao with 18.4 percent, Anheuser-Busch InBev with 14 percent and Yanjing with 10.7 percent, according to a report Wednesday on domestic news portal cnfood.cn.

The stiff competition, along with a slight decline in demand due to the sluggish Chinese economy, also drove domestic beer production down.

Domestic output in the first eight months of 2015 fell 6.1 percent year-on-year, while imports jumped 65.7 percent, according to a report posted Monday on domestic news portal qq.com.

Yan Qiang, a partner at the Beijing-based Hejun Consulting, told the Global Times Monday that the decline is "understandable" given the overall economic climate in China, adding the decline is not that significant.

Wang agreed but added that changing lifestyles in China and shifting preferences regarding alcohol consumption also contributed to the declining market. He said that as Chinese people pursue a healthier lifestyle, including a shift to spirits such as wine, it's natural that the demand for beer declines.

However, experts said that China is still a gigantic beer market by global standards.

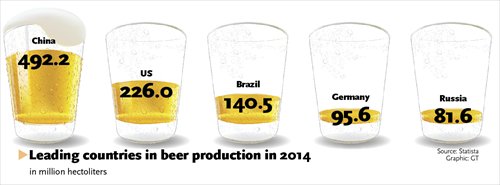

According to data from US-based online statistics portal statista.com, China's beer output reached 492.2 million hectoliters in 2014, more than twice that of the US.

China will overtake the US to become the world's largest beer market in value by 2017, financial news channel CNBC reported on July 29, citing a EuroMonitor International report.

Yan said that China will remain an enormous market for beer in the foreseeable future and stiff competition will persist.