Yuan fall will help, but could hit imports

China's annual export growth is expected to remain in positive territory this year, but negative export growth in some months cannot be ruled out, a spokesman for the Ministry of Commerce (MOFCOM) said at a press conference Wednesday.

Ministry spokesman Shen Danyang's comments came after China's exports fell by 0.9 percent year-on-year in the first seven months of 2015, and slumped by 8.9 percent in July alone.

"China's exports are facing tougher and more complicated situations at home and abroad, as well as a lot of uncertainties," he said.

Analysts from Bank of Communications forecast in a research note released on August 10 that it will be difficult for China to realize the annual export growth target of 6 percent, partly because of the high basis of comparison from the second half of 2014.

Weakening external demand, rising production costs, the yuan's appreciation over the past few years and the shifting of orders to other countries and regions are major factors affecting China's exports, the ministry said in a statement on Sunday, citing a survey of nearly 6,000 Chinese enterprises.

The yuan has fallen by nearly 4.6 percent against the US dollar since August 11 when China's central bank reformed the exchange rate formation system to better reflect market conditions.

The ministry said the yuan's devaluation would benefit export-oriented enterprises, but might create pressure for those that rely heavily on imports.

"The stronger yuan resulted in some of our orders moving to India and Southeast Asian countries instead," Chen Dongying, head of the operation department of Guangdong Guangxin Holdings Group, told the Global Times Wednesday.

She said the recent depreciation would help to boost the company's exports, which fell by 18 percent year-on-year in the first half of this year, but would also increase the cost of its imports of raw materials.

FDI in financial sector surges

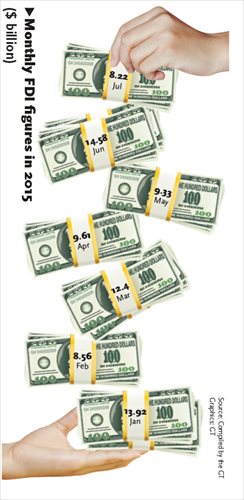

Data from MOFCOM also showed that foreign direct investment (FDI) inflows into China's financial services sector surged by 381.1 percent year-on-year in the January to July period.

The growth rate was much faster than that of total FDI, which rose by 7.9 percent year-on-year to 471.07 billion yuan ($76.63 billion) in the first seven months of this year.

"The boom in China's stock market earlier this year attracted FDI inflows into the financial services sector," said Liu Xuezhi, an analyst with Bank of Communications.

China's ongoing reforms in the financial sector, including trials in the newly established free trade zones, have also boosted foreign investors' confidence, Liu told the Global Times Wednesday.

In contrast, FDI into the country's manufacturing sector dropped by 5.4 percent year-on-year in the first seven months, reflecting China's industrial restructuring, analysts said.

Total FDI from Japan slumped by 24.2 percent year-on-year in the first seven months, while FDI from the US plummeted by 29.2 percent during the same period, according to MOFCOM.

"The two economies have rolled out a series of policies to bolster their domestic industries," Liu noted.

In addition to supportive policies, the yen's sharp depreciation has made Japanese exports more competitive, and market expectations for a near-term increase in US interest rates has also attracted capital flows back to the US, according to Liu.

Overseas investment falls

Meanwhile, China's outbound direct investment (ODI) fell by 18.6 percent year-on-year in July, marking a second consecutive monthly drop, following June's 15.5 percent year-on-year fall, the MOFCOM data showed.

Shen said that the drop was partly due to strong ODI figures in June and July 2014, which were boosted by several big investment projects.

Also, investment projects used to focus on the energy and resources sectors, but enterprises have become more cautious about these areas due to falling commodity prices, he said.

China's ODI in the mining sector slumped by 22.1 percent year-on-year during the January to July period, according to MOFCOM.

But data for a few months can not reflect the full-year situation, Shen said, adding that the annual growth of ODI will be between 10 percent and 15 percent this year.