Consumer inflation rises slightly, under control

Consumer inflation in China inched up slightly in July, the highest so far this year, but producer prices for the month slumped to their lowest level in almost six years, as some experts called for more monetary easing to support China's economy.

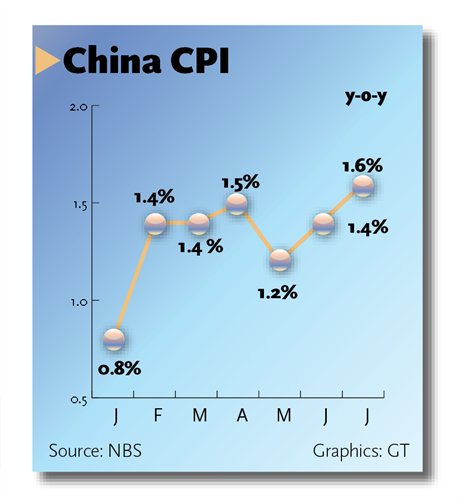

July's Consumer Price Index (CPI) of 1.6 percent, a main gauge of inflation, was up from 1.4 percent in June and 1.2 percent in May.

The July inflation rate was mainly attributed to rising pork and fare prices, the National Bureau of Statistics (NBS) said on its website. Pork prices have been rising since April amid tight supply. In July alone, pork prices soared 16.7 percent from the same period last year, according to the NBS.

Food prices contribute roughly 30 percent to the CPI, according to experts' estimates.

Driven by surging pork prices, the inflation rate in the next few months will continue to climb and may reach 2 percent in August and 2.5-3 percent in December, according to a research note from Huatai Securities sent to the Global Times on Sunday.

The market is concerned that the People's Bank of China (PBC), the country's central bank, may hesitate to implement further monetary easing measures given the rise in consumer inflation, as easing policies may exacerbate inflation, analysts said.

Analysts from Huatai Securities also said in the Sunday research note that the rise in inflation may stand in the way of further monetary easing.

But Zhuang Jian, a senior economist with the Asian Development Bank (ADB), believes that the mild rise in inflation will not affect the central bank's stance on monetary policies as more easing is needed to counter the mounting downward pressure on the economy.

The Producer Price Index (PPI), which measures the average change in prices received by domestic producers for their output, remained subdued in July.

The PPI dropped 5.4 percent from the same period last year, marking the 41st consecutive monthly fall and the lowest level in almost six years, NBS data showed.

"The PPI is expected to continue to report negative growth in the near future due to declining commodity prices and a weak demand for industrial products," Liu Xuezhi, an analyst with the Bank of Communications, told the Global Times on Sunday.

Liu noted that the lackluster PPI reading and other economic data all point to strong headwinds in the economy, and urged the government to come up with more monetary easing measures.

Customs data released on Saturday showed the country's total trade volume dropped 8.8 percent to 2.12 trillion yuan ($341.5 billion) in July, with export volume declining 8.9 percent and import volume dipping 8.6 percent from the same period last year.

Also, the purchasing manager index (PMI), which measures manufacturing activities, stood at 50 percent in July, 0.2 percent lower than in June, NBS data showed earlier this month, indicating that the manufacturing sector continues to experience tough times, especially smaller firms.

The PMI reading for small companies was 46.9 percent in July, the NBS said.

A reading above 50 percent indicates expansion and a reading below shows contraction.

Liu said that the inflation rate remains under control, leaving plenty of room for further monetary easing. The inflation rate has remained below 2 percent for 11 consecutive months. Despite the expected rebounds, Liu said he believes that the annual inflation rate for 2015 will hover between 1.5-1.7 percent.

Last week, the PBC also said that it will continue with its prudent monetary policy in the second half of the year and guarantee a reasonable liquidity level.

"More monetary support is needed for small firms as well as the agricultural sector," Zhuang told the Global Times on Sunday, adding that investment in infrastructure and emerging industries should also increase to meet the government's growth target of around 7 percent this year.

The growth in China's GDP slowed to a 24-year low of 7.4 percent in 2014 and further eased to 7 percent in the first half of this year.

It "won't be too hard" for the government to meet the annual target of 7 percent this year with proper monetary and fiscal stimuli, Liu said.

China has cut interest rates four times and lowered banks' reserve requirements three times since November 2014, most recently on June 27.

"More easing is expected in the next few months, with a cut in reserve requirements more likely," Liu said.