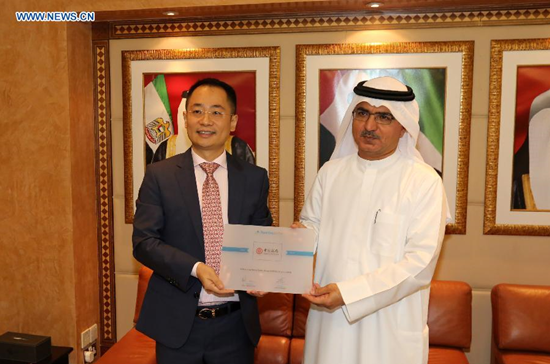

General manager of the Abu Dhabi branch of the Bank of China (BOC) Tian Jun (L) and Chairman of Nasdaq Dubai Abdul Wahed Al Fahim display a license in Dubai, the United Arab Emirates (UAE), on July 1, 2015. (Photo: Xinhua/Li Zhen)

The Bank of China's (BOC) Abu Dhabi branch listed on Wednesday its two billion yuan (322 million U.S. dollars) bonds for the Belt and Road initiative on Nasdaq Dubai, the Middle East's only international exchange.

The two billion yuan issuance was part of bonds raised by the BOC last month.

On June 25, the BOC said it had successfully raised the equivalent of 4 billion U.S. dollars from the international bond markets for the Belt and Road initiative, which aims to recreate the Silk Road and boost cooperation with countries along the ancient trading route.

The money will support projects to boost infrastructure links between Asia and Europe, the BOC said.

This is the biggest amount of bonds issued at one time by the BOC abroad, in four currencies -- yuan, U.S. dollar, Singapore dollar and euro.

Through its overseas branches, the BOC raised 2.3 billion U.S. dollars, five billion yuan, 500 million euros and 500 million Singapore dollars.

The bonds contain fixed interest securities and floating interest, with diversified terms to maturity.

The BOC plans to increase its credit scale to 100 billion U.S. dollars in the coming three years for Belt and Road projects.

Tian Jun, general manager of the Abu Dhabi branch of BOC, said the successful listing on Nasdaq Dubai shows international investors' confidence in the huge opportunities that China's Belt and Road initiative brings to the United Arab Emirates (UAE).

Essa Kazim, the governor of the Dubai international financial center of which Nasdaq Dubai is a licensed market, said Dubai will further strengthen its leadership position in linking the Middle East financial markets to China and other markets for the mutual benefit of all.

In 2014, China, surpassing India, became the biggest trade partner of the UAE as bilateral trade hit nearly 50 billion dollars.