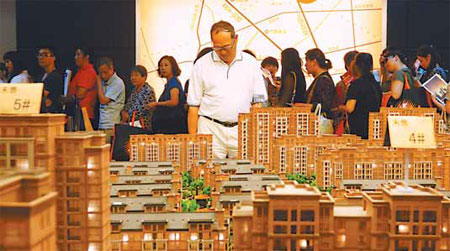

Homebuyers line up to choose apartments and sign contracts at a housing project in Hangzhou, Zhejiang province, on Monday. In August, newly built residential properties traded at 8,738 yuan ($1,380) per square meter on average, 0.24 percent higher from a month earlier. Prices rose for the third month in a row. Long Wei / for China Daily

Properties nationwide saw prices rise and transactions dip in August, but analysts expect both sales volume and prices to pick up again in September and October.

In August, China's newly built residential properties traded at 8,738 yuan ($1,380) per square meter on average, 0.24 percent higher from a month earlier, rising for the third straight month, figures from the China Real Estate Index System suggested on Monday.

According to the real estate research publication operated by Soufun Holdings Ltd, 63 out of the 100 cities tracked in the report saw higher new-home prices in August, with 10 of them up more than 1 percent from July.

The average new-home price in 10 major cities including Beijing and Shanghai stood at 15,539 yuan per sq m in August, up 0.45 percent from a month earlier but dropping by 1.49 percent from the previous year, representing a year-on-year fall for the eighth straight month.

The State Council sent eight inspection teams to 16 provinces and cities at the end of July to supervise the implementation of property regulation policies. In addition, the National Development and Reform Commission, the country's top economic planning agency, also vowed to take precautions against a price rebound in the property market. These measures both affected the growing momentum of property prices in August, the report said.

Another report, released by Centaline Property Agency's market research department, showed that a total of 262,416 newly built apartments were traded across the nation's 54 major cities, a drop of 5.7 percent compared with July's amount of 278,162 units.

But Zhang Dawei, head of the research department at Hong Kong-based Centaline, didn't take it as a downward trend for the whole property market.

"The decline in supply is the major cause of the sliding transaction volume," he said. According to Zhang, most of the developers' cash flow greatly improved after they reduced their property prices to build up cash in the first half of this year.

Meanwhile, more homebuyers take a wait-and-see attitude when tightening policies start to weigh on the property market, Zhang added.

sales in August. In Beijing, 14,525 homes were sold last month, 21.5 percent more than in July, while in Shenzhen, a total of 3,751 homes were traded, up 14.15 percent month-on-month. But both Shanghai and Guangzhou witnessed a drop in transaction volumes, said the Centaline report.

"Although Shanghai's transaction volume dropped 6.5 percent month-on-month, that was a 39 percent year-on-year increase," said Chen Yanbin, research director of the China Index Research Institute's Shanghai branch.

Chen said that a month-on-month drop in trade volume is normal because August is usually a low season for home-buying. Chen expected both the transaction volume and price to pick up in the peak season of September and October.

Hui Jianqiang, research director of Beijing Zhongfangyanxie Technology Service Ltd, a real estate information provider, however, said although home trading will improve in the following months, home prices will not see large increases.

"The market sentiment is quite complicated at this time. If home prices continue to rise, any further policy tightening is possible," Hui said.

James Macdonald, head of Savills China research, said that developers' inventory levels are still "at some of the highest levels ever seen, and so many developers are unlikely to start increasing prices significantly in the short term".

Copyright ©1999-2011 Chinanews.com. All rights reserved.

Reproduction in whole or in part without permission is prohibited.