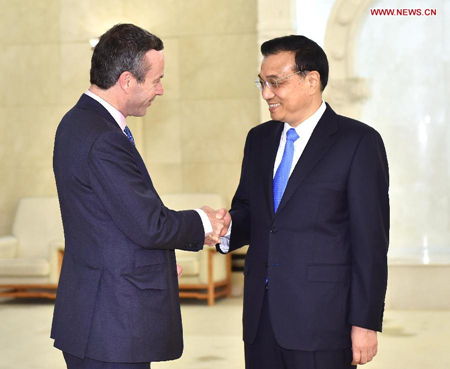

Chinese Premier Li Keqiang (R) meets with editor-in-chief of Britain's Financial Times Lionel Barber in Beijing, capital of China, March 31, 2015. (Xinhua/Li Tao)

On the afternoon of 31 March 2015, Premier Li Keqiang of the State Council gave an exclusive interview to Lionel Barber, Editor of the Financial Times, at the Great Hall of the People. The transcript is as follows:

Li Keqiang: Good to see you again, Mr. Barber. I recall that last year we met at a time when there were new developments in global economic recovery. And now we are still witnessing new dynamics in the global economy. Our meeting today also shows that China is ready for even closer interaction with the global economy, in which it has already become deeply integrated. And China is ready to continue to make its contribution to facilitating the global economic recovery. The correspondent you sent to China speaks Chinese so well that if I do not see him in person, I hardly know that he is a foreigner.

Barber: Premier Li, it's very good to be back in Beijing, resuming our strategic dialogue. I recall in our last conversation, we talked about the risks in the world economy. And we know that the central banks in America, Europe, Britain and Japan are engaged in unconventional monetary policy to maintain economic growth. But in our last conversation, you asked me whether I believe there were risks when this period of unconventional policy ends. And I said I thought they were manageable. Do you share that view as the US prepares to end its quantitative easing?

Li Keqiang: I have to say I am half convinced and half doubtful. When the QE is in place, there may be all sorts of players managing to stay afloat in this big ocean. Yet it is difficult to predict now what may come out of it when the QE is withdrawn. And although there is little debate about whether there will be an interest hike in the United States, people are quite uncertain about when this interest hike will take place. Honestly speaking, it is quite easy for one to introduce QE policy, as it is little more than printing money. But what about the structural problems that have led to the global financial crisis and weak economic recovery? We believe one needs to undertake structural reforms. Yet not that many countries have taken significant steps in this direction. This is like treating a patient. We need to give him IV drip and antibiotics. Otherwise, it may cost us the time to cure his disease. But eventually, one has to discontinue the use of antibiotics to allow the patient himself to recover on his own physical strength. So I'm not an outright opposer to QE, but I believe what is more important is the structural reforms.

Barber: Premier Li, I just come from Tokyo where I spent nine days in Japan looking closely at their economic experiment. I met with Prime Minister Abe for an hour for an interview. I wonder, are you concerned that the depreciation of the yen and the euro against the RMB means China is less competitive and you may have to devalue in response?

Li Keqiang: China has been advancing the reform of the RMB exchange rate formation mechanism to widen the RMB floating band and improve the market-based, managed exchange rate regime. For some time, there has been slight devaluation of the Chinese currency. But this is not because of the steps taken by the Chinese side, but because of a stronger US dollar. I believe the current value of the RMB is basically stable. We don't want to see further devaluation of the Chinese currency, because we can't rely on devaluing our own currency to boost export. Instead, what we need is to boost our domestic demand. Otherwise, it will be difficult for us to adjust our economic structure. We don't think companies in China should mainly rely on a devalued Chinese currency to boost export. Instead, they should focus on enhancing their competitiveness by raising the quality of products and making technological innovations. At the same time, we hope that all major economies will enhance coordination on macroeconomic policies. We don't want to see a scenario in which major economies trip over each other to devalue their currencies. That will lead to a currency war. And if China feels compelled to devalue the RMB in this process, we don't think this will be something good for the international financial system. This may ultimately lead to trade protectionism and impede the globalization process. This is something we don't want to see.

Barber: Premier Li, may I share with you one clear impression from my visit to Japan regarding Japan-China relations. The message from the highest level with whom I conducted many interviews was that China-Japan relations have improved. There is reference to the meeting between President Xi and Prime Minister Abe. And I wonder whether you think there is improvement, do you agree with that? And whether this is durable or just a pause. And there may be problems ahead, for example around the 70th anniversary and World War II statement that the Japanese government is planning to make.